Stablecoin Chains for Institutions (Part II)

How stablecoin L1s will win the distribution war through tokenized FX, agentic payments, invisible infrastructure, and branded partnerships to onboard billions via institutions.

This is Part II of this research.

In Part I, we explained that stablecoin-centric blockchains will achieve mass retail adoption not by directly attracting individual users from existing apps, but by first onboarding institutions such as banks and payment firms to integrate stablecoin rails into traditional finance flows.

In this part, we explain how this can happen. If you haven’t read Part I, read it here.

For stablecoin L1s to succeed in this dual strategy (top-down & bottom-up) and eventually serve billions, the core infrastructure must check several boxes. It’s not enough to issue a token and call it a day, these networks need to solve real-world frictions that currently limit crypto’s reach. Here are the crucial requirements which are being talked about less in front of low-gas fee or stablecoin denominated fee, etc.

FX will be tokenized

End-state, all FX lives on-chain: digital dollars, euros, yen, yuan, value hops currencies like packets. Today, though, the proliferation is mostly “digital dollars,” and it’s splintered across issuers. The way to keep UX simple is a Sanctum-style meta-pool for dollars: branded, GENIUS-compliant coins (e.g. Starbucks USD, McDonald’s USD) all interchangeable via one deep LP (e.g. USA₮/USAT).

Apps quote “USD,” route to the deepest pool, and users never see issuer complexity. Recent experiments (including new U.S.-regulated dollars and big infra players testing branded stables) point to exactly this: multiple issuers at the edge, one common liquidity spine.

MEV: fix the middleman cut and keep the good arbitrage

Bad MEV is like a middleman secretly taking a cut from a transaction for simply being part of the process. Enterprise payments can’t tolerate that. 2 practical fixes:

Make “good MEV” public and programmable. Expose chain-run/public arbitrage so anyone can supply to a MEV LP (even from a phone) and split the gains back to users/treasuries, rather than private extractors.

Carve lanes (separate blockspace) for payments/CLOB flows. Can be done with native compliance hooks, deterministic sequencing and settlement guarantees where needed (Stable style playbook), while leaving other lanes open for competition.

Agentic payments (lead with x402, then standards).

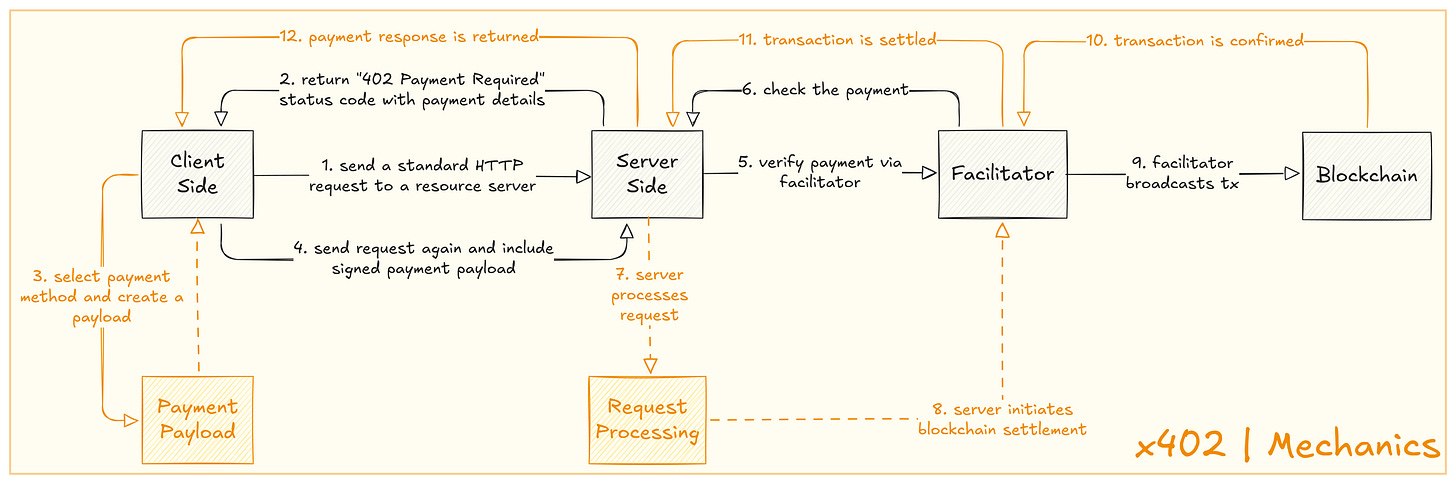

Coinbase’s progress on the recent Agent-to-Agent infrastructure has led to x402, which essentially is a upgraded HTTP-402 standard so agents can pay in stablecoins over plain HTTP: no accounts, no OAuth, instant settlement per request.

Layer on emerging agent-to-agent (A2A) standards from major cloud/payments players to add mandates, spending rules, and identity. Net effect: machines meter APIs, content, compute, and network services autonomously, paid in tiny stablecoin drips. This is where stable rails shine (sub-second, programmable, 24/7) and why “agentic commerce” becomes a first-class requirement.

Cross-chain

Don’t force a single chain. Accept “USD” at the edge and let the router pick the rail (whatever is cheapest/fastest: USDT on Tron, a U.S. bank-issued coin, a CDN-native dollar, etc.). The receiver auto-settles into their preferred token or fiat. Interop becomes a routing problem, not a user problem.

Stablecoins as Invisible Infrastructure

Most people won’t know or care about what a stablecoin L1 is, but they’ll use it daily.

Think Ethereum as the warehouse/settlement layer and stablecoin networks as the highway + FedEx trucks moving value between apps. Stable rails become the “middleware for the dollar (and other currencies),” handling payments, FX, and settlement so front-ends stay simple.

This aligns with the super-app thesis. Coinbase (and peers) aim to be your primary financial account: they’ll route under the hood across Base, stablecoin rails, Bitcoin, etc., while you just see a balance. The goal: replace 2–3% card tolls with payments that feel virtually free. Stable networks are how that happens.

Meanwhile DeFi gets abstracted. You tap “Earn” or “Swap”, the app chooses the cheapest/safest route (often a stable L1 for fiat-like flows). Identity abstraction replaces seed phrases and RPCs with email/biometric logins. We already saw hints of this with Reddit’s Vaults: millions interacted with crypto without realizing it.

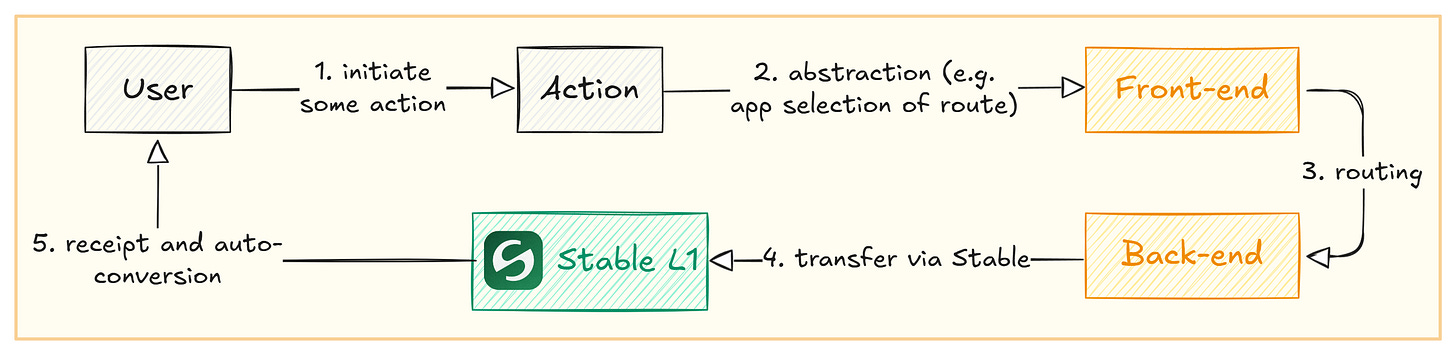

Another likely pattern is assets vs. flows. Long-term assets (stocks, funds) remain anchored on Ethereum-grade security, while everyday flows (purchases, payouts, remittances) zip across specialized stable rails. Software makes the wrap/swap/route invisible: sell a token to stablecoins, route over a stablechain, auto-convert on receipt: users just experience “pay anyone, anywhere, instantly.”

Zoom out and it looks like WeChat or Gojek, but supercharged by crypto features. Your app handles bills, savings, investing, chat, shopping. Behind the scenes, a router picks the optimal rail per action: Lightning for a BTC buy, a stable L1 for a payment, Ethereum for an NFT, and so on. The stablecoin network plays the role of the national/payment backbone.

Net result: apps talk to stable networks, users just get speed, finality, and low cost. Stablecoin L1s fade into the plumbing which is reliable, boring, ubiquitous moving trillions behind the scenes. Getting there isn’t only a tech race: it’s a go-to-market race of distribution, yield design, FX/liquidity routes, and partnerships — which is exactly where we go next.

Yield, Distribution, and the Go-To-Market War

Even if the infrastructure is perfect, stablecoin networks face a final boss: bootstrapping usage and beating out TradFi competitors. In an environment where crypto yields have collapsed (imagine a return to low global interest rates), attracting users and capital requires creative strategies beyond “we pay 5% on stablecoins” – because what happens when T-bill rates drop to 0.5%? The answer: distribution is everything. The stablecoin players know this, and we’re seeing a variety of go-to-market (GTM) approaches emerge.

New Models for Yield

During a high-rate environment, stablecoin issuers like Circle and Tether could offer yields or incentives funded by interest on reserve assets (which was 5%+). In a low-rate scenario, those juicy yields vanish. How, then, to entice users?

Some projects are experimenting with alternative reward models.

For instance, there are protocols like GENIUS and things like USAT (Tether’s U.S. affiliate coin) which may allow banks to pass through some interest or use other incentives.

Or a government might subsidize certain stablecoin uses, for example, giving a tax credit or higher FDIC-insurance-like protection for stablecoin accounts to encourage adoption.

Issuance fees or revenue sharing could also come into play: if a big brand issues a stablecoin on a network, they might get a cut of transaction fees or a portion of the float interest, providing an incentive to push it to their customers.

In short, yield might shift from pure interest to rewards, discounts, and utility. PayPal, for example, could offer cashback in PYUSD for using their stablecoin, retail stablecoins could tie into loyalty programs (imagine earning airline miles for holding a USD stable balance with an airline’s partner bank).

Branded Stablecoins and White-Label Distribution

As mentioned, Walmart and Amazon exploring stablecoins lit a fire under this concept. It’s plausible we’ll see a wave of “bring your own users” stablecoin deals. A chain or issuer might approach a corporation: “We’ll handle the tech, regulation, and reserve management, you slap your brand on a stablecoin that your millions of customers can use in your ecosystem.”

The company gets reduced payment costs and maybe new revenue streams, and the stablecoin network gets an instant user base. It’s analogous to how credit card networks courted retailers to issue co-branded cards (Amazon Visa, Apple Card, etc.), only now it’s co-branded digital cash.

The GENIUS Act makes this legally feasible in the U.S. by explicitly allowing private companies to issue digital dollars under oversight. So don’t be surprised if in a few years you have Starbucks Dollars (usable at Starbucks for extra perks), Walmart Cash (which could even be spendable outside Walmart eventually), or McCryptoCoin (buy a Big Mac, get some coins that can be saved or used elsewhere). Each of these would likely run on one of the stablecoin networks, whether it’s an existing public chain or a purpose-built consortium chain.

The competition among stablecoin L1s will in part be who can sign the biggest brands and banks to launch on their platform. It’s a distribution war reminiscent of the early days of smartphones (iOS vs Android scrambling to get app developers and OEM partnerships).

Cards and Consumer Apps

Ironically, even as stablecoins try to disrupt card networks, many are also embracing cards as a user acquisition tool. For example, Coinbase’s 4% crypto rewards Visa card is basically giving users yield for spending via stablecoin (they convert your crypto to USDC to pay the merchant, and give you 4% back in Bitcoin). This is subsidized by interchange fees, it’s leveraging the old system to grow the new.

We will see stablecoin wallets come with debit cards so people can spend stablecoins at any Visa/MasterCard terminal, while gradually encouraging direct stablecoin acceptance to reduce reliance on those rails. The idea is to offer the best of both worlds in transition: swipe your card, but settle via stablecoins on the backend, and earn rewards. Over time, once enough merchants accept stablecoins natively (or via instant conversion), the card layer could fade, but for now it’s a bridging strategy.

Consumer-facing apps are another battleground: every stablecoin issuer either has or partners on a wallet app. For example, Stable launched Stable Pay wallet, others will try to target emerging markets as well to make using USDT as easy as using Venmo. Circle has its APIs in many fintech apps. The race is on to capture mindshare such that when users think “send money,” they use your interface (with your stablecoin under the hood). Because if you control the front-end, you can switch out the backend as needed. That’s one reason Coinbase and others are pushing to be super-apps – to own the customer interface before banks or Big Tech do.

What to Expect?

Ultimately, expect a “stablecoin chain war” over the next few years that will be as much about distribution, branding, and regulatory capture as it is about blockchains. Each major player will tout some edge: one might have the fastest blocks, another the big brand partners, another the blessing of the Federal Reserve (imagine a Fed-approved stablecoin vs. a crypto-native one).

The winners will be those who secure the most real-world usage, which likely means aligning with institutions that have scale.

To loop back to our thesis: stablecoin L1s that are institution-first will outcompete those that are “user-first” in a vacuum. A cool wallet with 50k crypto users is not going to bank the world. But a stablecoin rail adopted by, say, Amazon for all its marketplace payments just might.

This may be a slightly irreverent pill for crypto purists to swallow, it means much of crypto’s success could ride on old-guard institutions and Web2 platforms playing ball. But if the end result is billions of people enjoying faster, cheaper, more inclusive financial services (even if they don’t know stablecoins are under the hood), that’s a worthy trade-off.

Hazeflow is a blockchain & crypto research firm focused on underlying technologies, product approaches, and functions of blockchain products.

Written by Nitin Jakhar, reviewed & edited by Pavel Paramonov.