Stablecoin Chains Are Not for Users: They're for Institutions (Part I)

Discovering why stablecoin L1s should prioritize traditional finance and institutions instead of DeFi and its users.

Contrarian Stablecoin Thesis

Stablecoin-centric blockchains (stablecoin L1s) won’t achieve mass retail adoption by luring users away from their favorite apps. Instead, they’ll grow by onboarding institutions that already own the payment lanes now.

In other words, the path to everyday users is through banks, payment firms, and big institutions first and through crypto wallets at the last. Current crypto networks are fighting over the same small pool of DeFi users while ignoring the much larger financial world outside.

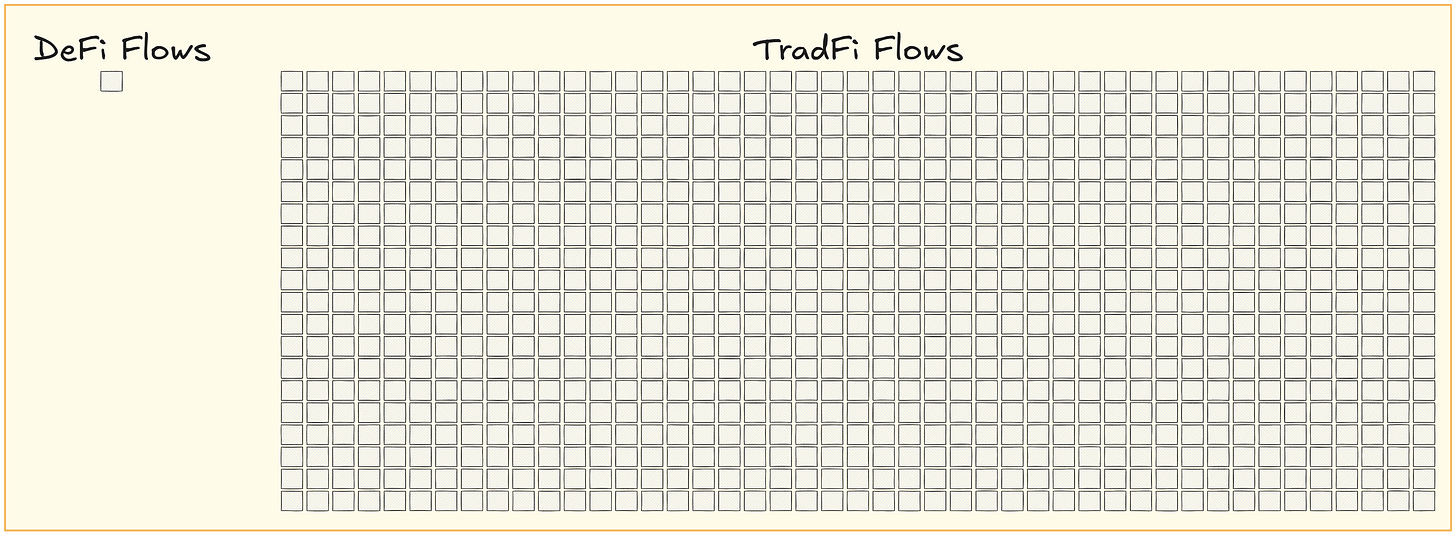

The ∼$28 trillion annual flows of DeFi are still just 0.12% of the ∼$24 quadrillion coursing through traditional finance.

To put that in perspective, traditional finance flows are about 857 times larger than DeFi’s current annual flows.

For every $1 in DeFi, there are about $857 in traditional finance.

Crypto may and will one day hold all the world’s liquidity, but getting from 0.12% to 100% will require stepping stones that bridge the gap between today’s tiny crypto ecosystem and the real economy.

Stablecoin L1s are in best position to build those bridges via practical interim steps, think tokenized FX markets, “agentic” commerce (AI-driven transactions), and DePIN (decentralized physical infrastructure), rather than expecting billions of new users to self-onboard to MetaMask tomorrow.

The recent much-anticipated launch of Plasma is a good case in point. It debuted with over 2 billion in DeFi liquidity with Day-0 integration with all of the major DeFi protocols, but at the same time it is ignoring the simple fact of onboarding outside users to crypto or especially DeFi and, like most crypto-native projects, is focused on recycling liquidity inside DeFi. And while DeFi may indeed become the backbone of global liquidity someday, that day isn’t today. The harder problem and the bigger opportunity is bringing new flows on-chain.

Many would try to frame this article as “institutions vs. users,” but rather it’s more useful to see it as a sequencing challenge. DeFi is a great proving ground, but scale comes from new flow, not deeper farms. The next step is to make more of the world liquid by taking FX pairs, tokenized assets, and even resource markets (uranium, silicon, compute) and plug those rails into the banks, PSPs, and apps billions already use.

That’s the bridge between today’s DeFi sandbox and tomorrow’s real economy.

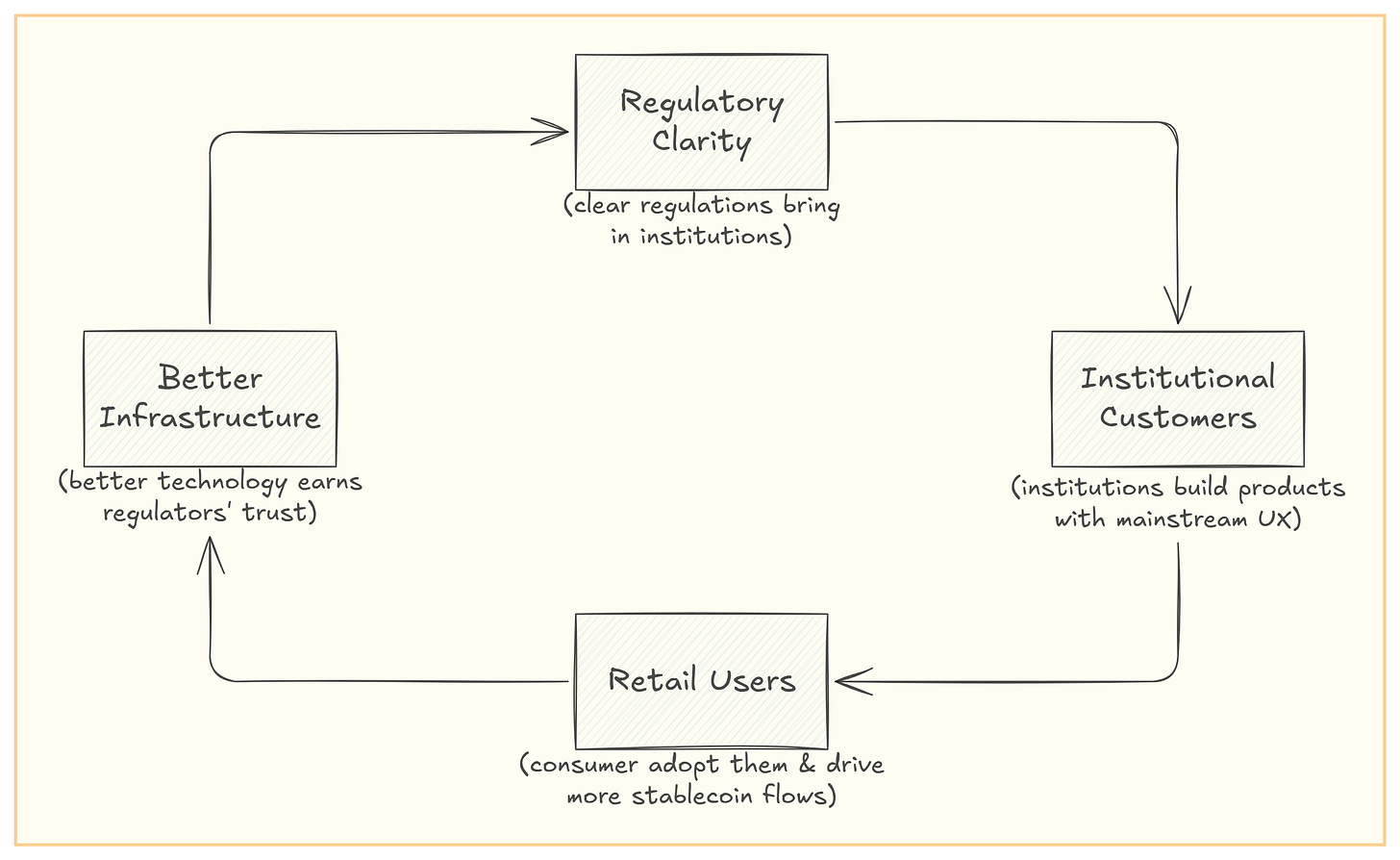

The Stablecoin Supercycle Flywheel

The stablecoin “supercycle” flywheel is what ultimately leads to retail adoption through institutional integrations, as depicted below:

Each turn of this cycle reinforces the next. For example, recent U.S. legislation (the GENIUS Act) established clear rules for stablecoin issuers to make major banks and payment companies start leaning in. And once “very trusted institutions” begin using stablecoins, that starts to move the flywheel.

To see how these “very trusted institutions” move the flywheel, let’s take a real-world example.

SWIFT is the standard for sending money through international wires. When a person in New York sends money to someone in Singapore, they don’t directly use SWIFT. Their bank/fintech intermediates everything (KYC/AML, FX, correspondent accounts) and uses SWIFT as the interbank messaging layer. Retail never touches SWIFT; institutions do. So if those same banks and processors start swapping parts of their back-end messaging/settlement to stablecoin rails, the retail experience (your bank app, your payroll, your checkout button) stays familiar; only the pipes get faster, cheaper, 24/7, and programmable.

Historical Analogies: Rails First, Users Later

It turns out crypto is no different from prior tech revolutions where a single pattern is visible i.e. the big winners built the rails first and worried about direct consumer adoption later.

Amazon Web Services (AWS) didn’t become a huge business by convincing millions of individual consumers to configure servers. Instead, AWS won over startups and enterprises as the backend infrastructure behind consumer apps. Users enjoyed faster, smarter apps without knowing (or caring) that AWS was under the hood.

Same goes with Visa Network, consumers didn’t spontaneously demand credit cards in the mid-20th century. Banks and merchants brought the technology to them. Visa started as a Bank of America initiative, signing up merchants to accept the card and other banks to issue it. Credit cards became widely used by consumers only after the necessary institutional framework was established.

Today’s stablecoins threaten to bypass Visa’s own rails, but the dynamic is similar: retailers like Walmart and Amazon are exploring issuing their own stablecoins to cut out card fees, potentially saving billions in interchange. Shoppers won’t adopt a WalmartCoin out of thin air, they’ll use it if Walmart slips it into their app for cheaper, smoother payments. The stablecoin L1 facilitating that (be it a public chain or a consortium chain) might never be explicitly advertised to shoppers as much as customers don’t think about the VisaNet data centers when tapping their card.

The similar analogy can be applied to Apple, the iPhone’s explosive growth after 2008 was driven not just by Apple’s shiny hardware, but by Apple courting developers (and eventually big companies) to build apps for everything. The App Store provided the rails (distribution, payments, toolkits) for third-party developers, whose apps then attracted billions of users. Apple focused on enabling an ecosystem, consumers flocked because of the experience (apps!) was compelling, not because they cared how the plumbing worked.

In crypto, the best user experience will similarly come from hiding the blockchain “plumbing”. Users don’t care about which chain or token powers their transaction, they care that it’s fast, cheap, and easy.

Users don’t care about rails, they care about the service

People are loyal to experiences, not infrastructures. Nobody outside crypto wakes up and says “I wish I could use more blockchains today.” They just want to pay rent, buy coffee, or send money overseas in the most convenient way.

If that means their existing bank or wallet app starts using a stablecoin L1 under the hood, they’ll happily benefit without ever hearing the word “stablecoin.” In fact, the best integration is one where the user doesn’t even realize blockchain is involved.

So, let’s see how these stablechains are making this “Whatsapp Moment for Crypto” a reality.

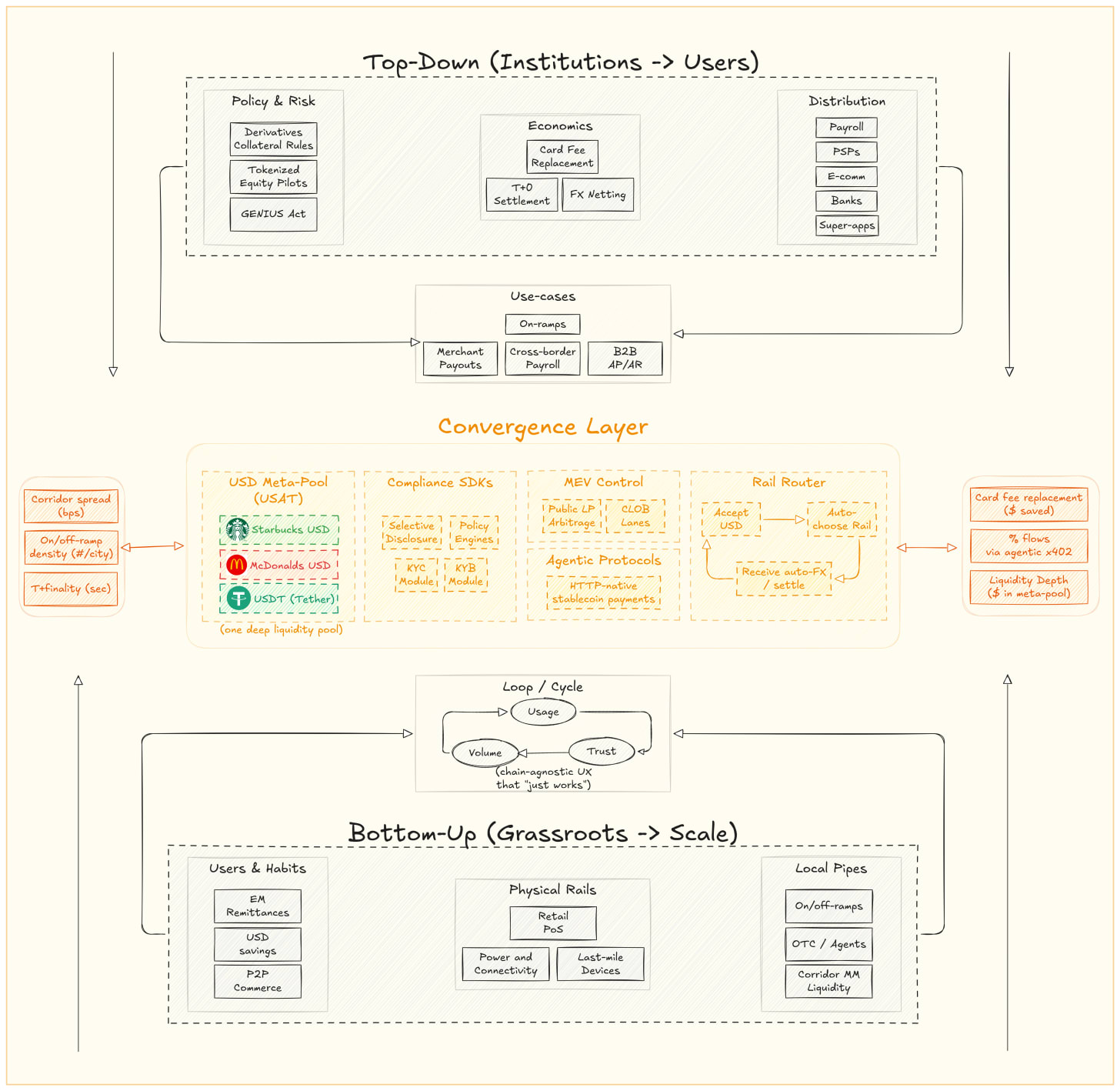

Two-Pronged Strategy: Infrastructure Top-Down and Bottom-Up

If stablecoin L1s are to reach billions of users, they need to attack the problem from both ends: Top-Down via institutions, and Bottom-Up via grassroots adoption. These approaches might seem opposite, but they are highly complementary and will eventually converge into a unified user payment experience. Let’s break down each strategy:

Bottom-Up (Grassroots via Tether’s Efforts and Others)

Long before U.S. tech bros noticed stablecoins, people in emerging markets like Argentina, Nigeria, Turkey, and Venezuela were using USDT as a lifeline (to deal with hyperinflation and national banking failures).

Tether who is responsible for more than 90% of the above volume has leaned into this organic adoption by investing in on-the-ground infrastructure.

It’s funding energy production and Bitcoin mining in places like Latin America (El Salvador, Uruguay) to bolster local economies (a stable financial system needs reliable power, after all).

It acquired a 70% stake in a renewable energy/agriculture firm (Adecoagro) to integrate blockchain with real-world industries.

Tether is also partnering with local startups and exchanges (e.g. funding a remittance-focused exchange in Chile) to improve stablecoin on/off-ramps in underserved regions.

There’s even talk of “tribal economy” integration, finding ways for remote or indigenous communities to use stablecoins where traditional finance has failed them.

All these efforts represent a bottom-up strategy: meet people where they are suffering from broken fiat systems, provide them dollar stability via stablecoins, and build physical and digital rails to embed crypto into daily commerce. And it’s working in many emerging markets, USDT is already the de facto dollar for remittances, savings, and commerce. And unsurprisingly, these users often have no idea what chain they’re on.

Top-Down (Institutions and Platforms Adopting Stable Rails)

In parallel to the grassroots push, stablecoin L1s pursue a top-down approach by integrating with institutions and enterprises. This includes fintech platforms, banks, payment processors, large corporations, even governments. The simple reason is that these players have massive user bases and transaction volumes and by convincing them to use stablecoin networks for things like foreign exchange, cross-border transfers, payroll, B2B settlements, etc., a stablecoin L1 can onboard millions at a stroke.

We’re seeing early signs of this. Tether backed chain Stable is explicitly built for USDT and positioned as backbone for banks and enterprises post-GENIUS Act which shows the fact that even U.S. legislators have warmed to this idea.

Those companies are exploring stablecoins not because they love crypto, but to save on the 2-3% card fees eating their margins. If they proceed, they’ll likely partner with an established stablecoin operator or infrastructure provider rather than build from scratch, which is exactly the distribution opportunity stablecoin L1s are vying for.

A prime example is Tether launching “USA₮”, a fully regulated US-dollar stablecoin for the American market. This gives institutions a compliant avenue to use Tether’s stablecoin within U.S. banking rails.

We can also imagine branded stablecoins as a service: e.g. “Starbucks Dollar” or “McDonald’s Dollar” issued on a stablecoin network, where the brand gets some incentives (like a share of interest revenue or reduced payment costs) and the stablecoin network gains millions of users transacting through a trusted brand’s app by making interop between them and USDT feel invincible.

Bottom-Up & Top-Down Combined Together

The dual-motion strategy is to push from both ends until they meet in the middle. Bottom-up adoption creates pockets of real users and volume (proving the tech and providing human stories of utility), while top-down integration brings scale and legitimacy. Eventually, they meet: maybe your autonomous AI shopping agent (a top-down tech integration) is paying a farmer in rural Nigeria (a bottom-up user) for some service, and it all happens via stablecoin rails without either party realizing it.

When that day comes, stablecoin L1s will truly have sewn together the quilt of global finance. Importantly, the end-user won’t “feel” any distinction, they’ll use their app or platform as always. Retail won’t even know they’re on a stablechain, just like most don’t know (or care) that much of USDT runs on Tron. And speaking of Tron, it’s a perfect example of how invisible infrastructure can quietly achieve massive scale.

Magic of TRX

Tron is a general L1 that effectively turned into a stablecoin rail by focusing on low fees and fast transfers. As a result, Tether heavily utilized Tron’s network for USDT.

Tron now processes over $21 billion in USDT transfers per day, 3x times more than Ethereum’s stablecoin volume, and even surpasses PayPal’s and Stripe’s daily volumes. It has 318 million+ accounts on-chain, largely thanks to exchanges, wallets, and P2P markets integrating USDT for users that just want cheap transactions.

Yet if you ask the average user sending USDT on Binance or a wallet, they might not know what Tron is – they just pick the network with the lowest fee. Tron’s story foreshadows how a purpose-built stablecoin L1 could capture huge volumes behind the scenes.

The users are not Tron fans: they’re Binance or Huobi or CashApp users who unknowingly ride Tron rails because it’s the path of least resistance. Stablecoin L1s want to replicate this dynamic across even broader domains (commerce, remittances, finance) to be the invisible highway underneath the apps.

Failure of XRP

Ripple was among the first crypto companies to align with regulators and even secured a seat on the ISO 20022 standards body. On paper, it looked perfectly positioned to become the institutional settlement ledger. Yet despite that head start, XRP failed to capture meaningful institutional liquidity. Why?

Because it pushed XRP as a currency rather than neutral infrastructure, forcing banks to take balance-sheet risk on a volatile token.

Its validator set remained relatively centralized, offering little beyond serving as a proprietary payments rail.

Ripple often promoted its own standards in opposition to SWIFT, rather than integrating with it, and even paid intermediaries like MoneyGram to simulate adoption instead of driving organic use.

The result: despite early compliance and a strong narrative, XRP’s strategy alienated both banks and developers, showing that regulation alone isn’t enough, real institutional rails require openness, interoperability, and neutrality.

Extension

This is Part I of this research. In Part II, we will cover how exactly stablecoin chains (stablechains) can succeed and how a stablecoin network can become a super-app.

Hazeflow is a blockchain & crypto research firm focused on underlying technologies, product approaches, and functions of blockchain products.

Written by Nitin Jakhar, reviewed & edited by Pavel Paramonov.