Institutional Crypto Series (III): The State of Asset Manager Tokenization: A $4.37B Market Analysis

The $4.37B tokenization market is accelerating as major asset managers move traditional investment funds onto blockchain for faster, more efficient on-chain finance.

This article is part of the Institutional Crypto Series. You can read the second installment by following this link: Institutional Crypto Series (II): The Next Evolution of Real-World Asset (RWA) Markets.

Thanks to RWA.xyz for providing comprehensive data and analytics that made this market analysis possible. Their platform continues to be an invaluable resource for tracking the evolution of tokenized real-world assets.

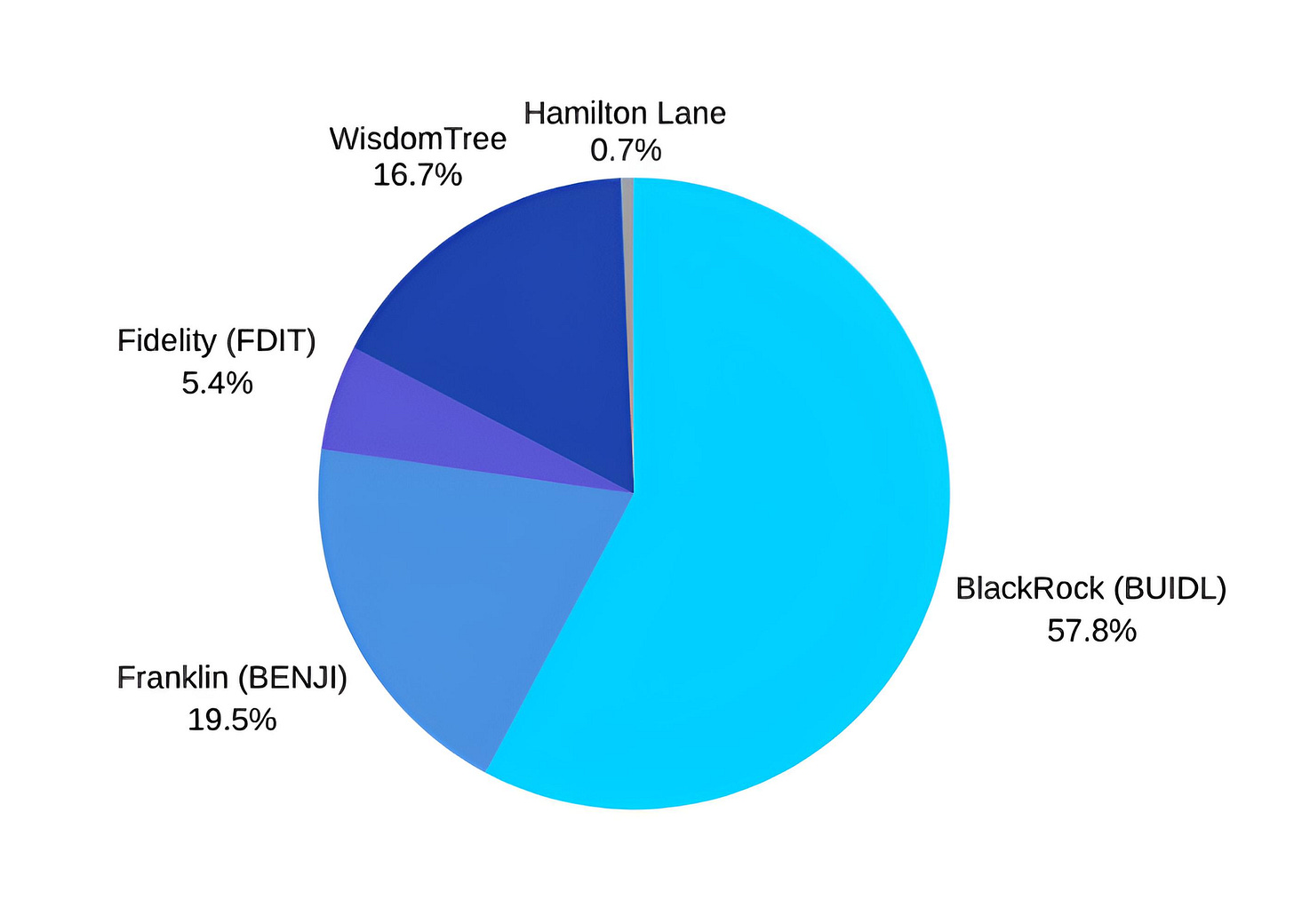

Six of Wall Street’s largest institutions have moved onto the blockchain. BlackRock, Franklin Templeton, WisdomTree, Fidelity, Hamilton Lane, and UBS now operate tokenized funds worth $4.37 billion combined, representing 13% of the entire $33.71 billion real-world asset (RWA) tokenization market.

When firms managing trillions deploy resources to build blockchain infrastructure, they’re committing to a fundamental shift in how institutional capital moves.

What is Asset Manager Tokenization?

Traditional asset managers are putting regulated investment funds on the blockchain. You get a token representing your share of a fund that could hold U.S. Treasuries, corporate bonds, equities, or private credit, depending on the product.

The difference from traditional funds is instant transfers, 24/7 access, and the ability to use your investment as collateral in other applications while still earning yield.

BlackRock BUIDL: The Market Leader in Tokenized Treasuries

BlackRock, the world’s largest asset manager with more than $13.5 trillion under management, entered onchain finance in March 2024 with a new product: the BlackRock USD Institutional Digital Liquidity Fund (BUIDL).

BUIDL is BlackRock’s first tokenized fund issued on a public blockchain, launched in partnership with Securitize, a tokenization platform and SEC-registered transfer agent that handles the technical infrastructure and regulatory compliance for blockchain-based securities.

Investors can subscribe through Securitize Markets to access this fund, which invests 100% of its assets in cash, U.S. Treasury bills, and repurchase agreements.

BlackRock’s Tokenized Fund

Fund name: BlackRock USD Institutional Digital Liquidity Fund (BUIDL)

Launch date: March 20, 2024

AUM: $2.52 billion (–11.44% over the past 30 days)

Asset Class: U.S. Treasuries

Holders: 97 (institutions only; all wallets are whitelisted)

Yield: 3.77% APY(7D), distributed as onchain monthly dividends

Minimum investment: $5,000,000

Platform: Securitize (SEC-registered transfer agent & broker-dealer)

Custodian: Bank of New York Mellon

BUIDL holds mostly short-duration U.S. Treasuries and repos. It remains stable at $1 and pays out a yield automatically. Because it is a regulated security, only verified institutional investors can buy or transfer it.

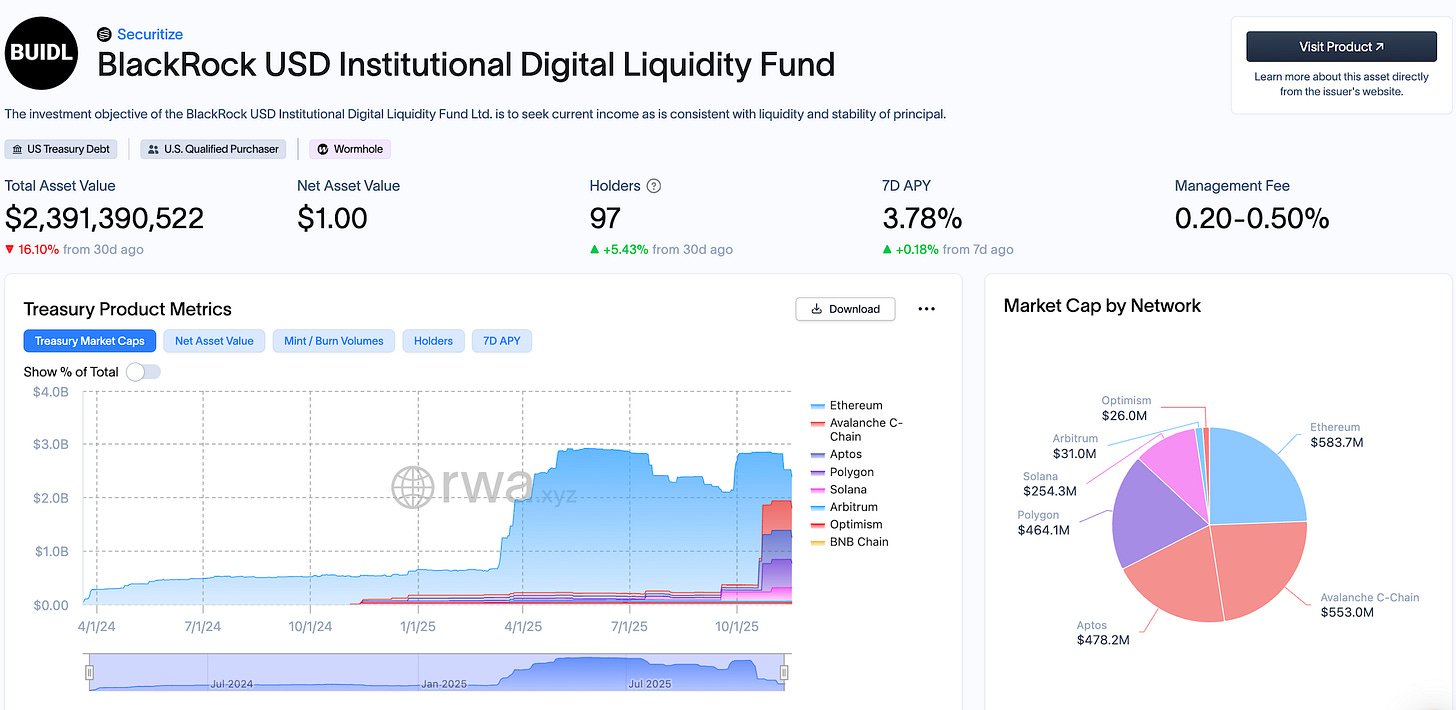

Multi-Chain Presence (8 Blockchains)

BlackRock’s BUIDL launched exclusively on Ethereum in March 2024, maintaining single-chain operations for the first seven months. In late October 2024, BlackRock initiated a multi-chain deployment, expanding to Avalanche, Polygon, Arbitrum, and Optimism.

The distribution remained heavily Ethereum-concentrated through mid-2025. By July 1, 2025, while the fund had grown to $2.86 billion, Ethereum still commanded 93.06% ($2.66 billion) of total assets, with other chains holding minimal shares: Avalanche at 1.88%, Aptos at 1.67%, and remaining chains below 1.1% each.

A dramatic rebalancing occurred between July and November 2025. By November 15, 2025, BUIDL’s $2.52 billion was distributed nearly equally across four major chains:

Ethereum: 23.12% ($583.6M)

Avalanche: 21.91% ($553M)

Aptos: 21.58% ($544.7M)

Polygon: 21.02% ($530.6M)

This shift marks a move from heavy Ethereum concentration to a more balanced multi-chain spread, with the top four networks now holding nearly equal allocations. Securitize clarified that “chain selection and allocation decisions are entirely determined by investors,” which means the drop on Ethereum wasn’t a pullback by BlackRock; investors simply redistributed their holdings toward Avalanche, Aptos, and Polygon.

BUIDL Holder Distribution

BlackRock’s BUIDL fund has 97 total holders as of November 2025, with a highly concentrated ownership structure. The top five holders control approximately $2 billion of the fund’s $2.5 billion in total assets:

Holder 1 (Aptos): $501.4M

Holder 2 (Polygon): $501.2M

Holder 3 (Avalanche): $501.2M

Holder 4 (Ethereum): $262.8M

Holder 5 (Solana): $229.1M

The top three holders each hold nearly identical amounts (~$501M), suggesting coordinated institutional deployments or strategic rebalancing across the chain:

Key Developments

1. Binance Now Accepts BUIDL as Collateral

Binance, the world’s largest crypto exchange, now allows institutions to use BUIDL as trading collateral. This matters because:

Traders can earn yield (~4%) on their posted collateral. Exchanges treat BUIDL as high-quality collateral, often safer than stablecoins. BlackRock is issuing a BNB-Chain share class to support this integration. This follows similar moves by Deribit and Coinbase-owned derivative platforms.

2. Onchain Operations

Yield is paid directly on-chain every month. Current redemption: token → redemption wallet → wire transfer. Future plan: on-chain redemption into USDC, already tested at 1:1. Long-term goal: fully on-chain funding and settlement without banks.

3. Regulatory Structure

BUIDL is a Reg D security. Only KYC’d, whitelisted institutional wallets can hold it. Peer-to-peer transfers are allowed only between approved wallets.

Fidelity FDIT: The New Challenger in Tokenized Treasuries

Fidelity Investments is a Boston-based financial services company established in 1946, with $5.9 trillion in assets under management. The firm began exploring blockchain technology in 2014 by mining bitcoin and launched Fidelity Digital Assets in 2018 for institutional crypto services.

The firm began exploring blockchain technology in 2014 by mining bitcoin and launched Fidelity Digital Assets in 2018 for institutional crypto services.This was a “tipping point” for institutional blockchain adoption, with Fidelity now competing directly with BlackRock’s BUIDL in the tokenized Treasury market.

Fidelity’s Tokenized Fund

Fund name: Fidelity Digital Interest Token (FDIT)

Launch date: August 4, 2025

AUM: $235.4 million (early-stage growth of +5.81% over the past 30 days)

Asset Class: U.S. Treasuries

Holders: 3 (institutional investors only)

Platform: Fidelity Investments

Custodian: Bank of New York Mellon Corporation

FDIT represents one share of the Fidelity Treasury Digital Fund (FYOXX), investing at least 99.5% of assets in cash and U.S. Treasury securities. The fund maintains a stable $1 NAV and charges a 0.20% management fee (with a 0.05% waiver effective through August 31, 2027).

Single-Chain Presence (Ethereum Only)

As a newly launched product, FDIT operates exclusively on Ethereum as an ERC-20 token. Unlike BlackRock’s established multi-chain infrastructure, Fidelity has taken a focused approach, deploying all tokens on a single blockchain at this early stage.

FDIT Holder Distribution

Given its recent launch just three months ago, FDIT has 3 holders with highly concentrated ownership:

Holder 1: $233.4M (99.15% of total) - Ondo Finance, serving as the anchor investor

Holder 2: $1.0M (0.43%)

Holder 3: $1.0M (0.42%)

Ondo Finance’s dominant position reflects its role as the initial anchor investor, using FDIT as a reserve asset for its OUSG yield-generating token. The limited holder count is typical for newly launched institutional tokenized products.

Key Developments

Strategic Launch with Ondo Finance: Fidelity partnered with Ondo Finance as its anchor investor at launch, providing immediate liquidity. Ondo’s OUSG token, which has grown to over $730 million in total value locked, now uses FDIT as part of its diversified reserve assets alongside BlackRock’s BUIDL, Franklin Templeton’s BENJI, WisdomTree’s WTGXX, and Wellington Management’s ULTRA. This positions FDIT within a broader ecosystem of institutional tokenized products.

Regulatory Framework: FDIT is registered under the U.S. Securities Act Form N-1A for Mutual Funds and regulated by the SEC, establishing a compliant foundation for future growth.

Recent Trend (Since Launch)

Growth: +$13.3M in 30 days (+5.81%) - showing steady early adoption

Holders: Growing from 2 to 3 institutional participants (+50% expansion in holder base)

As a three-month-old product competing against BlackRock’s 20-month head start and $2.5B AUM, FDIT represents Fidelity’s fresh entry into the tokenized treasury space, with significant room for expansion as more institutions discover and adopt the product.

Franklin Templeton BENJI: Tokenized Treasury Overview

Franklin Templeton is a global investment management firm with $1.65 trillion in assets under management, operating in over 150 countries with more than 75 years of investment experience

Franklin Templeton launched BENJI in 2021 as the first U.S. registered mutual fund to use blockchain for processing transactions and recording share ownership, representing shares of the Franklin OnChain U.S. Government Money Fund (FOBXX).

Franklin Templeton’s Tokenized Fund

Fund name: Franklin OnChain U.S. Government Money Fund (BENJI)

Launch date: 2021

AUM: $794.68 million (+0.02% over the past 30 days)

Asset Class: U.S. Treasuries

Holders: 940 (+0.97% over the past 30 days)

Yield: 3.87% APY (30D)

Platform: Franklin Templeton Benji Investments

Eligible Investors: U.S. and Global Retail

BENJI is one of the only tokenized MMFs available to both retail and institutional investors, depending on jurisdiction.

Multi-Chain Expansion

Franklin Templeton’s BENJI started as a Stellar-only product and gradually began expanding. By late December, BENJI had moved onto two chains with $325.51 million in assets, though it remained overwhelmingly concentrated on Stellar at 99.3% (with only $161 on Arbitrum and $2.06M on Polygon).

By late December 2024, BENJI had reached seven chains with $555.0 million in assets. Stellar’s dominance had reduced to 53.29% ($293.8M) as other ecosystems gained traction:

By November 16, 2025, BENJI had grown to $849.7 million across 10 chains, showing a significant reconcentration toward Stellar.

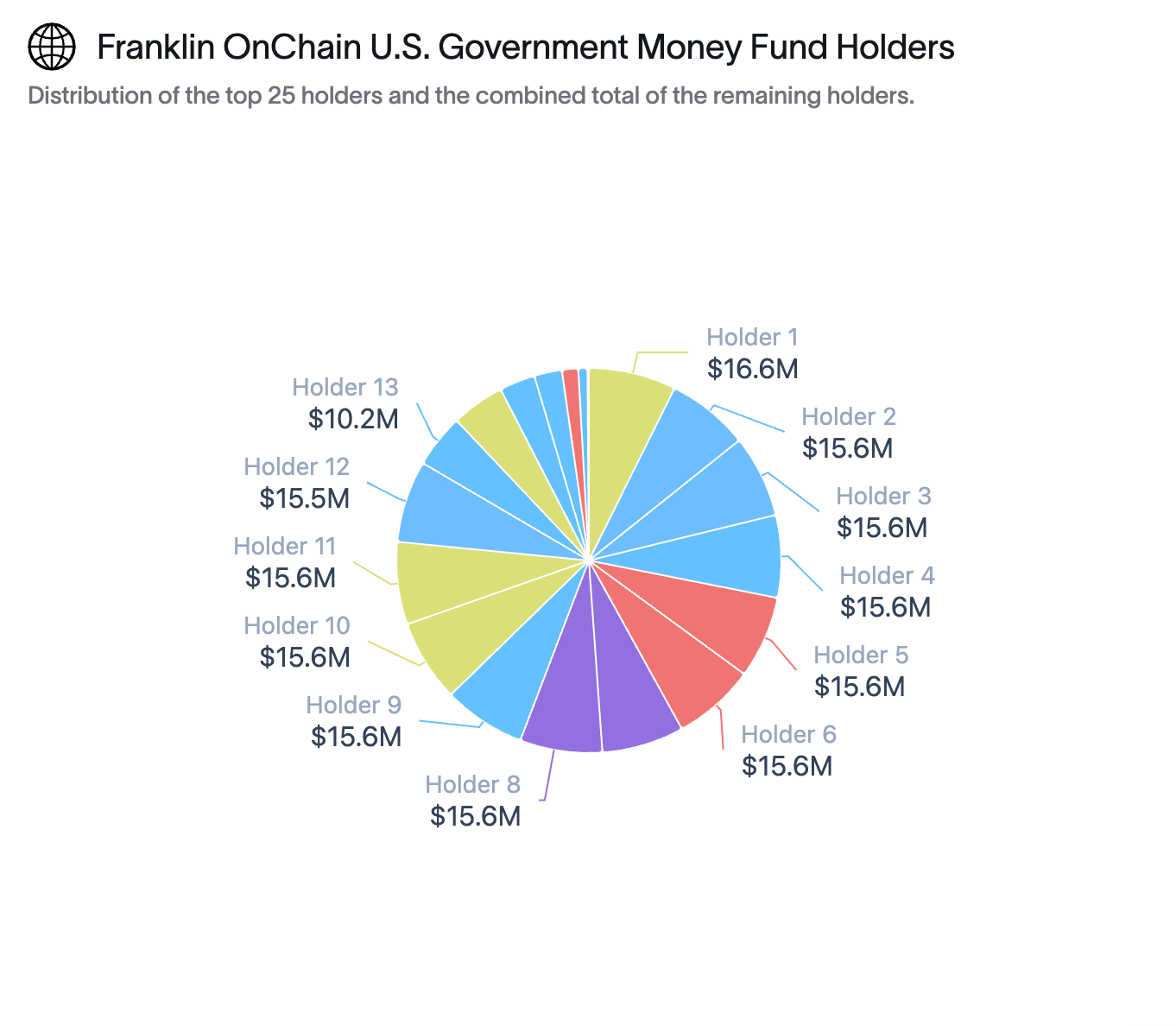

Holder Concentration

Unlike BUIDL and FDIT, BENJI has broad distribution:

940+ holders (mixed retail + institutional)

No single dominant holder shown in available data

Used across multiple jurisdictions and financial apps

BENJI is the most accessible of the major tokenized MMFs.

Key Developments

1. Early Pioneer in Tokenization (Since 2021)

BENJI launched in 2021 on Stellar, the first U.S.-registered mutual fund on blockchain.

2. Canton Network Integration (Nov 2025)

BENJI expanded to Canton Network, a permissioned blockchain used by institutions handling multi-trillion-dollar markets (e.g., Broadridge $4T+ monthly repos). This enables:

Privacy-preserving settlements

Collateral management

Regulated institutional workflows

3. Broad Institutional + Enterprise Adoption: Used for:

Broad Institutional & Enterprise Adoption: Use Cases

Collateral in CeDeFi (BounceBit)

Treasury management

Multi-chain payments (VeChain)

Institutional settlement flows (Canton)

DeFi integrations (Arbitrum, Ethereum, Base)

WisdomTree: The Diversified Leader in Tokenized Assets

WisdomTree is a global asset manager and financial innovator listed on the NYSE (ticker: WT) with over 20 years of experience building and managing regulated investment products. The company has been recognized on Fortune’s list of America’s Most Innovative Companies 2025 for its leadership in offering tokenized real world assets (RWA) to both retail and institutional investors.

WisdomTree pioneered tokenized assets in October 2022 with the launch of WTGOLD (WisdomTree Gold Token), making it one of the earliest major asset managers to embrace blockchain technology. The company has systematically expanded its offerings, growing from $664,504 in October 2022 to $728.84 million by November 2025 - a remarkable 1,096x growth over three years.

WisdomTree’s Tokenized Platform

Platform name: WisdomTree Connect (institutional) & WisdomTree Prime (retail)

Pioneer launch: October 2, 2022 (WTGOLD)

Total AUM: $728.84 million (+16.31% over the past 30 days)

Number of Assets: 15 tokenized products (largest collection in the market)

Asset Classes: Money Market, Equities, Fixed Income, Commodities, Private Credit

Holders: 2,050 (retail and institutional)

Eligible Investors: Both U.S./Global retail and institutional investors

Platform: WisdomTree (SEC-registered funds under Investment Company Act of 1940)

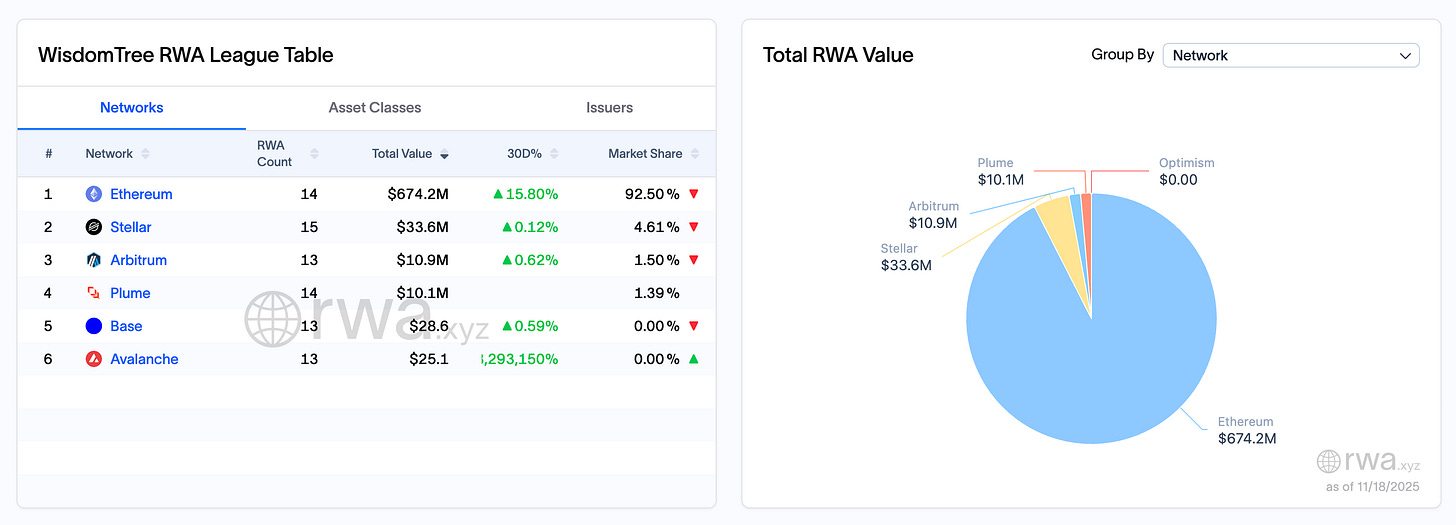

Multi-Chain Presence

WisdomTree deployed its tokenized funds across six blockchains as of November 2025:

Ethereum: 92.50% ($674.2M)

Stellar: 4.61% ($33.6M)

Arbitrum: 1.50% ($10.9M)

Plume: 1.39% ($10.1M)

Base: 0.00% ($28.6)

Avalanche: 0.00% ($25.1)

Complete Fund Lineup with Launch Timeline

WisdomTree launched its tokenization platform in October 2022 with WTGOLD and a short-term treasury fund, starting with just $1.66 million. The company systematically expanded through five phases: adding five treasury funds in January 2023 ($6.72M), launching the breakthrough WTGXX money market fund in November 2023 (now $694.79M flagship), diversifying into six equity and multi-asset funds in 2024 ($29.37M), and introducing private credit in 2025.

Growth Trajectory

October 2022: $664,504 (WTGOLD + WTSYX only)

December 2022: $1.66M (+150%)

January 2023: $6.72M (+304% - Major treasury expansion)

November 2023: $7.66M (+14% - WTGXX launch)

December 2024: $29.37M (+283% - Equity funds added)

September 2025: $864.82M (+2,844% - WTGXX dominance)

November 2025: $728.84M (-16% from Sep peak, but +16.31% from Oct)

Key Developments

Retail-Focused Innovation WisdomTree Prime Visa Debit Card allows users to spend directly from tokenized funds, earning yield on daily purchases. WisdomTree Prime is available in 45 U.S. states.

Stablecoin Integration Full USDC support for subscriptions and redemptions. WisdomTree launched USDW, its proprietary stablecoin, as the transactional layer for seamless value movement.

Multi-Asset Portfolio Building Institutions can build complete diversified portfolios on-chain across 15 different strategies without leaving the ecosystem.

Regulatory Structure All funds registered under the Investment Company Act of 1940. Uses soulbound NFTs for wallet verification. Only verified, permissioned wallets can transact.

As the pioneer that launched 17 months before BlackRock’s BUIDL (October 2022 vs March 2024), WisdomTree has established itself as the most diversified tokenized asset platform, offering retail accessibility alongside institutional solutions across 15 different investment strategies spanning 3+ years of continuous innovation.

UBS Asset Management

On November 1, 2024, UBS Asset Management launched its first tokenized investment fund, the “UBS USD Money Market Investment Fund Token” (uMINT), built on Ethereum blockchain technology. The fund provides institutional-grade cash management solutions backed by high-quality money market instruments, available through authorized distribution partners.

Thomas Kaegi, Co-Head of UBS Asset Management APAC, noted growing investor appetite for tokenized financial assets, prompting UBS to leverage its global capabilities and collaborate with regulators to deliver innovative solutions.

Hamilton Lane

In Q4 2022, Hamilton Lane partnered with Securitize to tokenize its funds, marking the first time Hamilton Lane products became available in tokenized form in the U.S., dramatically reducing minimum investments from typical $5 million requirements to $20,000.Hamilton Lane has been active in private markets for over 24 years and its data shows private equity funds have outperformed public markets in 19 of the last 20 years.

Hamilton Lane Tokenized Funds on Polygon (via Securitize)

HLEOV (Equity Opportunities Fund V) — closed Jan 2023 at ~$2.1B.

HLSCOPE (Senior Credit Opportunities Fund) — launched May 2023, evergreen private credit.

HLSF6 (Secondary Fund VI) — launched Aug 2024 with ~$5.6B in commitments.

HLSPCA (SCOPE Private Credit Access) — launched via Libre SAF VCC structure.

Hamilton Lane also joined Securitize’s $47M strategic funding round led by BlackRock in 2024.

Conclusion

The tokenized asset management market has rapidly matured into a $4.37 billion industry in ~2 years, led by established financial giants who are fundamentally reshaping how institutional capital moves.

BlackRock’s $2.52 billion BUIDL dominates the tokenized Treasury space, while Franklin Templeton’s $849.7 million BENJI pioneered retail accessibility since 2021. WisdomTree leads in diversification with 15 tokenized products across $728.8 million, Fidelity’s $235.4 million FDIT represents the newest major entrant, and Hamilton Lane has democratized private equity access with $29.5 million in tokenized funds.

These platforms have collectively reduced minimum investments from millions to thousands of dollars, enabled 24/7 trading with instant settlement, and introduced innovative use cases like using yield-bearing assets as collateral or spending directly from tokenized funds via debit cards. As UBS and other trillion-dollar managers enter the space, tokenization is transitioning from experimental technology to core financial infrastructure, proving that blockchain-based assets are not just an alternative, but increasingly the standard for how modern finance operates.

The sheer pace of institutional adoption is whats most striking here. BlackRock going from zero to $2.5B in BUIDL within 20 months shows how fast major players can scale once they commit. The multi-chain rebalancing you documented is fascinatig too, especially how investor prefrence drove assets away from Ethereum to Avalanche and Polygon. Makes you wonder if gas costs or settlement speeds are the real driver behind those allocation shifts.