Institutional Crypto Series (II): The Next Evolution of Real-World Asset (RWA) Markets

IoT oracles revolutionize RWAs by tokenizing physical assets with real-time data, enabling programmable DeFi, DePINs, and trillions in unlocked value.

This article is part of the Institutional Crypto Series. You can read the first installment by following this link: Institutional Crypto Series (I): Verifiability of Actions.

Tokenized real-world assets (RWAs) have become a buzz phrase on Wall Street and in crypto circles alike.Despite headlines touting billions in “tokenized assets,” actual on-chain RWA volumes remain modest, around $17 billion excluding stablecoins(~$300 b), these numbers may seem low and there was a debate upon static/unused RWA capital deployed which shows a greater number of ~$36 billion. Even flagship categories like tokenized U.S. Treasuries amount to just a few billion in assets under management, versus roughly a $20 trillion traditional Treasury market.

These statistics are not an argument against the promise of tokenization but rather they highlight how early the industry is at the moment.

Most current institutional RWA products focus on narrow, familiar securities (high-grade bonds, funds, money market equivalents), which is just a tiny slice of the hundreds of trillions of value sitting in real-world assets. All the major asset managers forecast $2-16 trillion of tokenized RWA by 2028.

Current Limitation of RWA on blockchains

To date, most tokenization efforts have focused on straightforward financial products because they have clear legal structures and existing markets. But these familiar assets are only a small percentage of global wealth. The real world is very big, the true opportunity lies in all kinds of tangible and complex assets. For example:

Real Estate: Commercial, residential, and agricultural properties.

Infrastructure: Toll roads, bridges, airports, power plants, etc.

Commodities & Natural Resources: Crops, oil & gas, minerals, timber .

Equipment & Inventory: Industrial machinery, vehicles, shipping containers .

Intellectual Property & Contracts: Patents, music or film royalties, long-term service agreements.

Collectibles & Luxury Goods: Fine art, classic cars, wine collections.

Environmental Assets: Carbon credits, water rights, renewable-energy certificates.

Each of these categories contains trillions in latent value and most remain illiquid, opaque, and unpriced in real time. The fundamental reason is that they cannot yet be denominated in continuous, machine-verifiable data.

Unlike financial securities whose entire lifecycle is digital(and can be put on Blockchain using oracles like Chainlink) these assets operate in the physical world, where data about their state (output, utilization, location, condition) is either unrecorded or trapped in siloed systems. Without reliable streams of structured telemetry, a blockchain cannot evaluate or enforce the underlying economic claims of such assets. Simply put, what cannot be measured cannot be tokenized.

This is precisely where IoT oracles enter the premise.

Oracles 2.0

RWA depend on physical facts, and blockchains alone can’t enforce contracts without reliable off-chain data. Traditional finance relies on legal and custodial intermediaries (auditors, inspectors, custodians) to verify things like rent payments, production milestones, or collateral status.

On-chain RWAs have to replace those assurances with code which means they must have a trusted bridge to the real world.

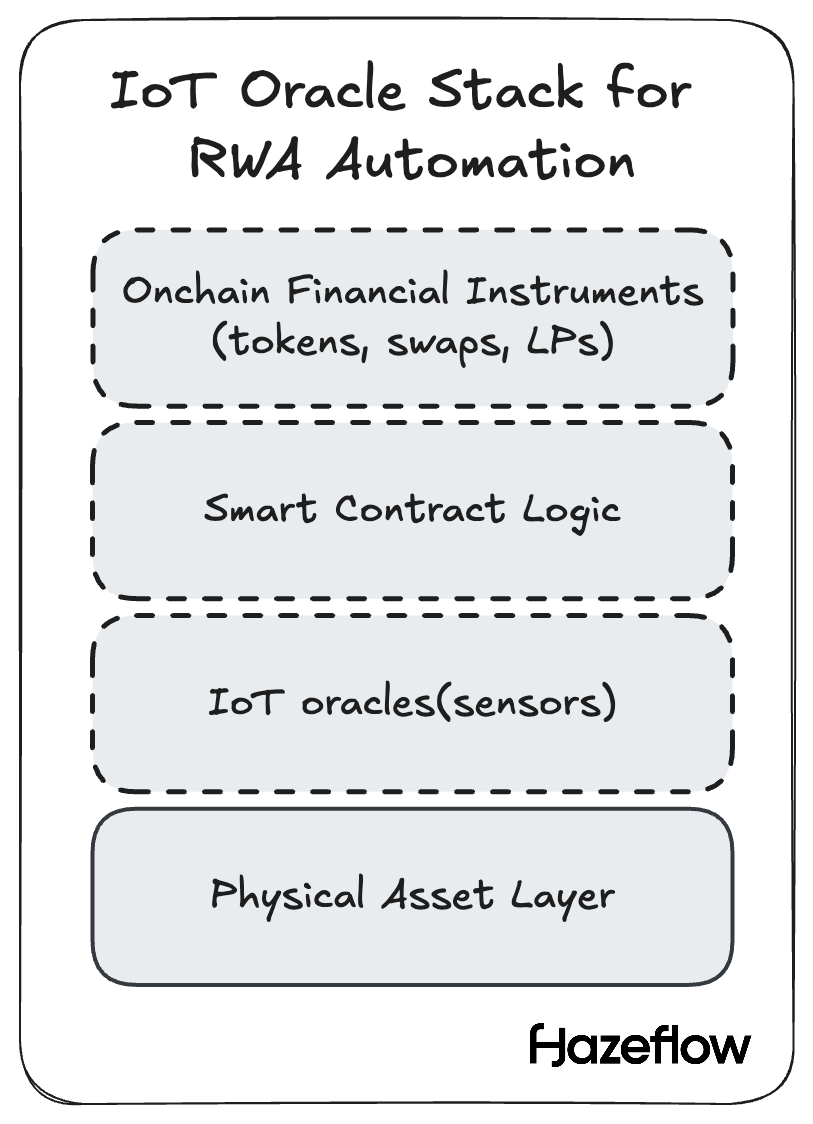

By embedding sensors, meters, and smart devices directly into the physical environment, IoT oracles will convert real-world activity into authenticated, real-time data streams that blockchains can trust.

IoT oracles will stream virtually anything measurable: operating hours, crop moisture, GPS location, or energy yield which can be transmitted, hashed, and verified on-chain enabling smart contracts to trigger payments, insurance settlements, or ownership transfers automatically.

By continuously feeding verified metrics into code, they transform static assets into programmable digital tokens assets that evolve, accrue value, or settle obligations as real-world conditions change.

In short, any asset that can be continuously monitored can enter the on-chain world and once it does, markets can begin to price and trade its performance directly, forming the foundation of the next wave of financial innovation.

Creating New Markets from Real-World Data

One of the most powerful implications of IoT oracles is that any measurable event can become a tradable data point. By publishing real-world data to the blockchain, entirely new markets can emerge.

For example, consider healthcare: if hospital bed availability, equipment usage, and procedure pricing were fed live into on-chain oracles, parties could arbitrage cost differences across regions, book underutilized resources in real time, or create insurance pools around utilization metrics.

In agriculture, IoT-verified crop yields or weather data could underpin new futures or insurance contracts.

In manufacturing and logistics, machine uptime or shipping-container location could be tokenized into revenue-linked securities.

And in energy, continuous telemetry from solar farms or grids could drive dynamic power-trading markets.

In each case, a physical event that was once hidden or siloed becomes a financial primitive.

Composable Finance

Once assets are tokenized and verifiable on-chain, they become building blocks for entirely new financial products. Smart contracts don’t care whether a token represents Bitcoin or a barrel of oil, they can combine diverse assets in complex structures. Imagine a permissionless environment where anyone can:

Collateralize tokenized GPU compute leases to hedge against surging AI training costs.

Long or short IoT-linked weather derivatives, for example betting on rainfall levels that drive crop insurance.

Trade BTC (or stablecoins) for tokenized pension-fund cash flows or other income streams as one package.

These kinds of cross-asset products are difficult in legacy finance due to siloed data and varying regulations, but on-chain protocols make them straightforward. IoT oracles provide the connective tissue needed: by verifying each asset’s performance in real time, they let these diverse RWA tokens interact under institutional-grade conditions.

The emergence of decentralized sensor networks often referred to as DePINs (Decentralized Physical Infrastructure Networks) is already laying the groundwork for IoT-oracle-driven markets. Projects like IoTeX, Helium, Chirp, WeatherXM, Geodnet, and DIMO demonstrate how physical data collection itself can be decentralized, verified, and rewarded on-chain. Each network specializes in a different sensing vertical connectivity, mobility, environmental data, or geolocation but all share a common architecture: individuals deploy sensors or gateways, stream authenticated data to the network, and earn tokens for contributing to the shared data layer.

In effect, these systems turn the world into a living oracle one where location pings, temperature readings, and energy outputs flow directly into digital markets. As these networks mature, they will provide the infrastructure for AI and autonomous agents which will be more than 99% of internet traffic in future to consume trustless, real-time data from the physical world and transact on-chain without human mediation which will be the true foundation of the coming machine economy.

The Future

The ultimate evolution of tokenization will merge physical assets, IoT devices, and programmable contracts into a single real-time economy where every measurable activity becomes a financial signal, some examples below:-

Pay-Per-Use and the Machine Economy

Instead of purchasing machines outright, enterprises will lease them through blockchain contracts that meter usage directly via IoT sensors.

A CNC machine or solar inverter could stream data to a smart contract that calculates operating hours and automatically settles payments in stablecoins. The vendor retains ownership; the user pays only for what they consume.

Electricity, Bandwidth, and the Rise of Intangible DePINs

Among all sectors, the electricity industry is the most advanced and utilizing this system. Power is an intangible asset which is already digitized and measured via smart meters. IoT oracles can feed this data into blockchain systems to enable micro-settlement, demand-response auctions, or decentralized energy trading.

Similar logic underpins networks like Helium, where bandwidth, another intangible, becomes a tokenized resource. Yet, derivatives such as electricity futures or power-price hedging remain largely off-chain. As data reliability improves, these high-value derivative markets will migrate on-chain, creating transparent, composable hedging and yield instruments.

Tokenized Service Contracts and Automated Enforcement

Beyond goods and energy, services themselves can be tokenized. Construction projects, cloud-compute leases, or data-center GPU rentals can be represented by tokens whose cash flows depend on IoT-verified milestones. Smart contracts could disburse funds progressively as oracles confirm task completion. Enforcement shifts from human to algorithmic: non-payment can trigger automated collateral seizure or disable IoT-linked equipment, much like remote-kill switches in vehicles today but executed transparently on-chain.

Auditing and compliance, too, become autonomous: every data feed leaves an immutable trail, enabling real-time ESG or regulatory proofs without manual paperwork.

Conclusion: From Passive to Programmable Assets

Tokenizing real-world assets is only the first step. To truly unlock their value, those digital tokens must be programmable and responsive to the actual world. IoT-powered oracle infrastructure is the bridge that makes on-chain assets come alive. By continuously supplying trusted, real-time data, oracles anchor digital tokens in reality, enabling automated payouts, dynamic pricing, embedded compliance, and cross-asset DeFi.

For institutions, the takeaway is clear: platforms that build rock-solid IoT oracle layers will have the advantage, because those infrastructures will determine whether we can truly tap into trillions of dollars of real-world value through code.

The real world is full of value, but it only becomes liquid when it’s visible and verifiable and IoT oracles can make that leap. The next evolution of global finance will depend on assets becoming truly programmable and interoperable, with real-world data at their core. Without this foundation, the promise of on-chain RWAs will remain out of reach.

Regarding the topic of the article, your point that 'statistics are not an argument against the promise of tokenization but rather they highlight how early the industry is' really hit home. It's such a clear perspecive. It reminds us how much potential is still untapped, beyond just stablecoins.