Institutional Crypto Series (I): Verifiability of Actions

As institutional crypto surges, blockchain verifiability dismantles inefficiencies, fraud, and trust gaps, forging transparent, auditable futures for finance and beyond.

The institutional interest in crypto is the highest it has ever been: institutions want to get involved either by investing in digital tokens, transitioning part of their infrastructure onto blockchain rails, or discovering new use cases enabled by crypto. However, it’s tough out there: both for crypto-native users navigating the institutional landscape and for institutions trying to understand what’s worth their time.

In a new multi-part series called “Institutional Crypto,” we will describe what’s important for institutions in this space and what’s not, what different types of TradFi firms are looking for in the blockchain industry, why it’s happening now, and how to navigate this landscape.

Our global goal is simple: we want to eliminate the cumbersome complexity of blockchain faced by nearly everyone inside and outside this space. Now, we want to fix it for institutions and anyone interested in the institutional crypto landscape.

In Part I (the one you’re reading right now), we will cover the institutional space from the perspective of interactions between components, systems, and people overall: and why institutions might consider moving their infrastructure (at least parts of it) on-chain.

Why are we beginning this series with verifiability?

We believe that verifiability is the most important and the most scalable feature of the blockchain industry, one that can be applied to a variety of different products outside the crypto space. People want to know the truth without having to trust anyone (media and information, in general); scientists want to make sure their hypotheses are definitively proved or non-provable; and computer systems want to ensure their algorithms work exactly as they’re supposed to.

Every part of this applies to institutions, as they are probably some of the most complex structures in the modern world: thousands of infrastructure systems, millions of people involved, and billions of outcomes and actions happening every day.

Are we saying that current institutions’ systems are not functioning properly? Yes.

What do institutions miss and lack?

Large institutions suffer from frequent errors, delays, and poorly coordinated processes. It doesn’t matter how much money an organization has or how much it has raised: it lies in the nature of institutions: they are large systems with a lot of hierarchy and approval processes. When you have that level of complexity, everything not only moves slowly (wasting time) but also leads to fraud within the organization and an inability to capture upcoming opportunities (wasting money), and most people also operate inefficiently, waiting for approvals for weeks or even months (wasting resources).

Operations Inefficiency

TradFi infrastructure is full of friction: in capital markets, it can take six weeks to issue a bond and almost a month for a dividend payment to reach investors. Settlement systems are aging and slow: about 27% of settlement technology is over 20 years old. These delays tie up capital and increase costs (settlement costs in capital markets grow by ~14% each year).

Payment networks and banks also have large back offices with too much manual reconciliation. Small errors in payment processing can compound quickly: companies end up spending up to 20% of a transaction’s value just on recovering from failed payments and reconciliation issues. Institutions can lose up to 20–30% of their revenue to operational waste each year.

Trust as Fundamental Assumption

When processes become too complicated, involving thousands of interactions, hundreds of people, and dozens of systems, it naturally becomes difficult for stakeholders to ensure that outcomes are correct or at least minimally deviate from the true value.

A major historical case was the collapse of a company called Enron, which involved widespread accounting fraud that led to the energy company’s bankruptcy, as complex off-book entities hid massive debts. Investors lost their money, and thousands of employees lost their jobs as well as a portion of their retirement savings.

The most important conclusion we can draw from this story is that complex systems with no oversight can allow fraud to grow undetected. Disorganized record-keeping lowers stakeholder trust: funds or clients have to assume the institution is handling things correctly, but they cannot easily verify it. This is true in other sectors too: supply chain firms struggle to verify product origins, and governments struggle to show taxpayers exactly where their funds go. In all of these processes, the lack of verifiability leads to errors and misconduct.

Legacy

Institutions carry a lot of legacy. They deal with outdated core systems that may cause transaction errors → fintechs and payment processors grapple with fraud and data mismatches across partners → supply chains see goods “disappearing” due to siloed databases.

In each case, the institution lacks a single source of truth that all parties can observe. The result is often finger-pointing and slow manual fixes. For instance, 68% of companies say their finance teams waste a lot of time on payment operations, and over half of payment processes still involve manual steps, which naturally leads to high error rates and delays.

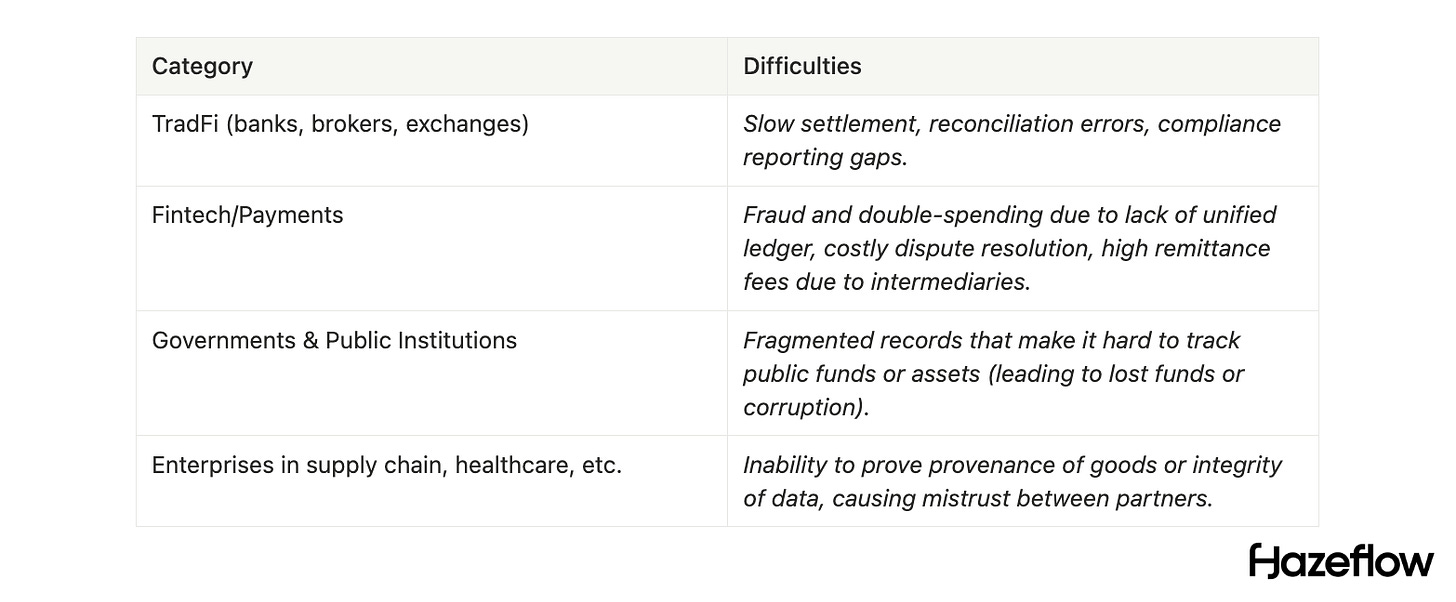

Our thesis is that current institutional systems lack a guarantee that everything is running correctly. Different types of institutions experience this pain in different ways:

How exactly can current systems be fixed and improved?

Actions can be verifiable and auditable by design. If key processes are moved on-chain, institutions gain an unchangeable record of all events which is shared across participants. Below we explain how adding crypto-style verifiability can improve current systems.

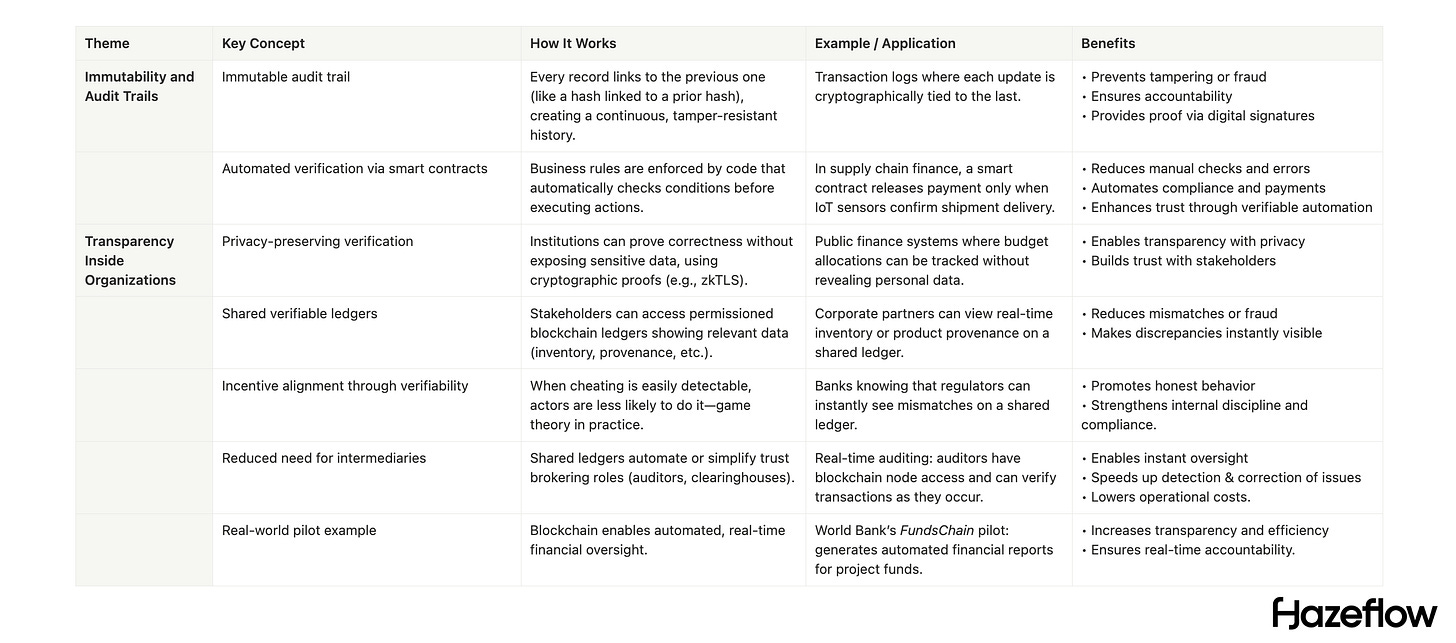

Immutability and Audit Trails

An immutable audit trail is created when every change is directly linked to the previous change, if we translate it to crypto terms, “when a hash is linked to the hash of the prior state.” Systems can trace every step of a transaction’s history, mistakes can’t be covered up, and fraud entries can’t be covered up. Undeniable proof is here: digital signatures prove who executed a transaction. Of course, any system has some pitfalls, but this is far better than relying on trust to improve accountability inside large organizations.

Verification can also be automated. Smart contracts can enforce business rules and automatically check conditions. A smart contract could be used in supply chain finance to automatically release payment once a shipment is delivered and IoT sensors report the arrival, where payments will only execute if all verifiable conditions are met. Systems essentially trust code to handle the workflow, which is far better than trusting paper trails or manual checks.

Transparency Inside Organizations

Institutions can prove to others that they are acting correctly without revealing sensitive data (privacy-preserving protocols and zkTLS-style of verification).

For example, a blockchain-based audit trail in public finance can let citizens and oversight bodies track every dollar from budget to outcome. In corporate culture, a company could offer partners access to some kind of permissioned ledger showing product provenance or inventory levels. Increased transparency means issues like mismatches or fraud become immediately visible to all stakeholders.

Game theory tells us that when defection or cheating is easily detected, actors are far less likely to attempt it. Verifiable actions change incentives: if a bank knows any mismatch in its books will be obvious to regulators (because records are on a shared ledger), they will try as hard as possible to avoid it.

In many institutional processes, multiple middlemen exist to broker trust (clearinghouses, auditors, etc.). Verifiable ledgers can reduce the need for some of these, or make their jobs easier. Real-time auditing becomes possible: instead of waiting for quarterly reports, an auditor could have node access to the company’s blockchain system and observe transactions as they happen (or at least get cryptographic proofs of them). One World Bank pilot, FundsChain, is using blockchain to produce automated financial reports for project funds in real time. This kind of instant oversight means problems are caught and corrected sooner.

If verifiability is so great, why isn’t everything on-chain yet?

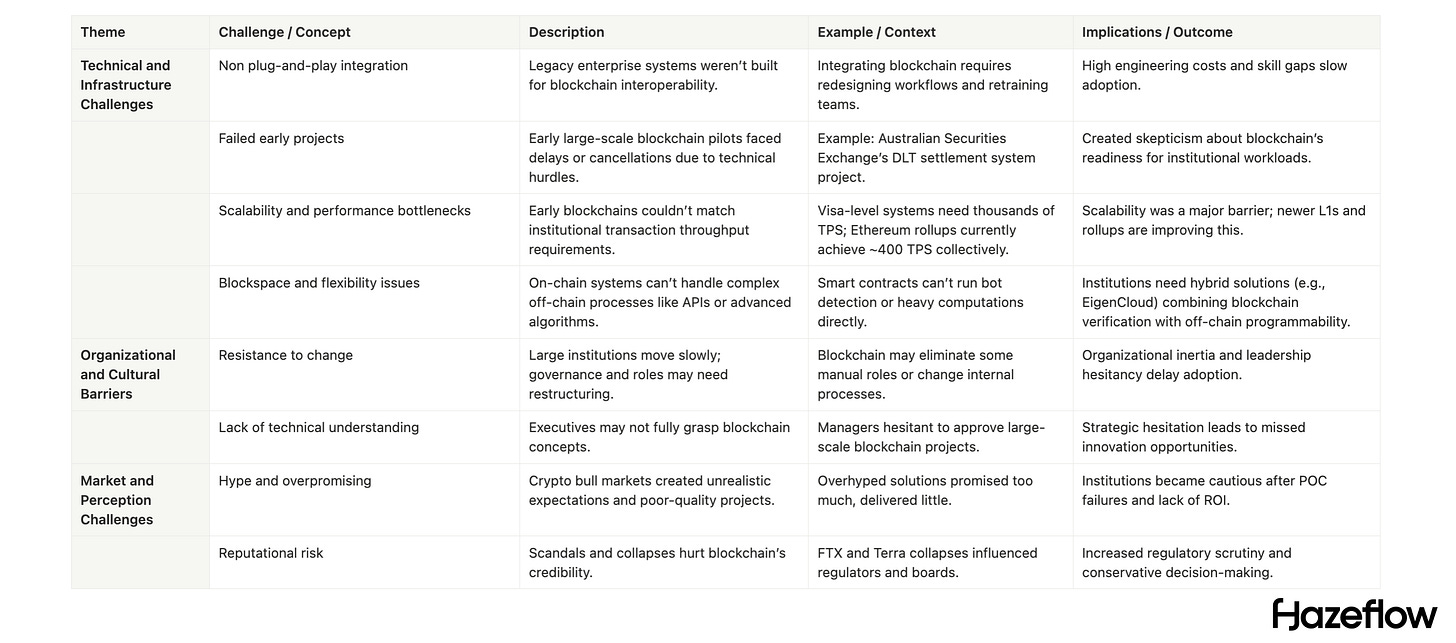

Adoption of verifiable principles seems pretty obvious, but there are several reasons why it wasn’t implemented before as well as why institutions are not rushing to implement it right now. There are several challenges, and past obstacles have slowed adoption, including limitations of existing blockchain infrastructure and the unwillingness of managers to adapt to new things.

The most obvious thing that we can point out is transparency. But we mentioned transparency as a good feature in the previous section, didn’t we? Yes, but blockchains usually operate with radical transparency. No major bank or large institution is comfortable moving billions of dollars on a completely public ledger where every transaction detail is visible to competitors or outsiders.

Institutions have legitimate confidentiality requirements (client data, trading positions, etc). Early on-chain solutions seemed “all or nothing”: either you use a fully public chain (transparent but exposing sensitive info) or you stick to private databases. Only recently are hybrid approaches emerging (like zk proofs and privacy networks) that offer privacy with actual verifiability. This verifiability without full public visibility is considered a holy grail for regulated markets, and networks like the Canton Network allow participants to verify data accuracy without revealing all details publicly. The need to balance transparency with privacy has been a key reason institutions held back on blockchain projects.

Moving on-chain is tough when you have a ton of legacy

Unfortunately, implementing crypto-grade verifiability is not a plug-and-play solution for institutions. Many enterprise processes weren’t designed to run on smart contracts or to share data externally in real-time. Rewriting or interfacing these systems with blockchain involves significant engineering effort and new skills that organizations may lack.

Besides that, smart contract platforms have their own limitations, as they mostly require dealing with limited scalability and programming in unfamiliar languages. The “expressiveness of code” on-chain can be lower: complex business logic might need to be simplified to run within blockchain constraints, which naturally limits the ability for institutions to operate efficiently.

Some early blockchain projects (like the Australian Securities Exchange’s attempt to replace its settlement system with DLT) failed or were delayed due to technical complexity.

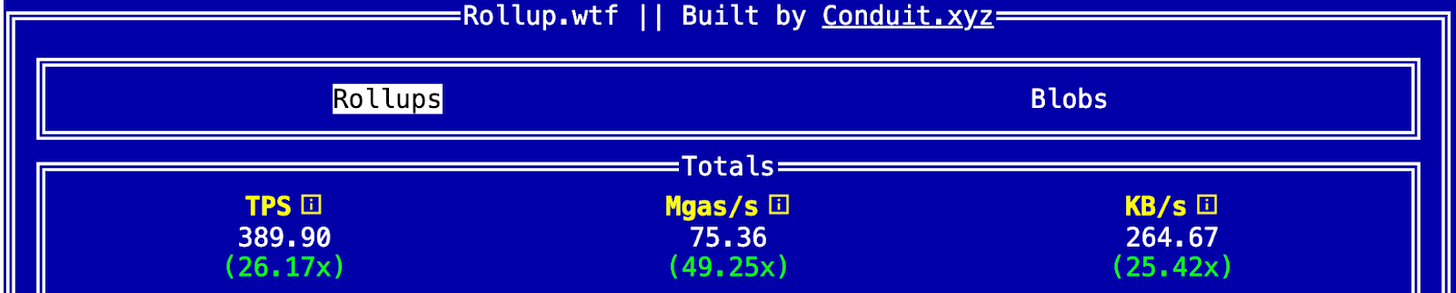

Early blockchains had issues with throughput and latency. Institutional systems often need to process thousands of transactions per second (think Visa’s payments or stock trades). Traditional blockchains couldn’t meet those demands without compromising security or decentralization. Newer innovations (rollups, L1s focused on speed) are addressing scalability, but for years this was a valid blocker.

The most famous example here is the absence of flexibility of blockspace. Currently, all rollups on Ethereum do around 400 transactions per second (TPS) collectively.

That might mean that the majority of blockspace is free considering most of the rollups are capable of thousands of TPS; however, it’s not true. While there is a lot of blockspace to fill available, it doesn’t suit legacy systems. You can’t call an API, run bot detection algorithms, or do anything complex on-chain. Most of the smart contracts are not designed for that, so alternative solutions are needed that combine on-chain verifiability and the programmability of traditional systems, like EigenCloud.

Large institutions are inherently slow to change. Processes and people gravitate to the status quo. Implementing blockchain verifiability might cut out certain manual roles or require new governance models. Top management might not deeply understand the tech and thus hesitate to greenlight major projects.

Previous Bad Image of Crypto Industry

There’s been a lot of hype in the crypto world, especially during bull runs. Institutions saw buzzwords flying around, but many projects hid their true value propositions under layers of complexity.

Adoption is hampered by “over-promised benefits” and “under-delivered business value.” Many organizations grew wary after proofs of concept failed to show immediate improvements. The crypto bubble and bust cycles also played a role; headlines about scams or collapsed crypto firms (FTX, Terra) further made boards and regulators cautious. So even if verifiability sounded good, decision-makers weren’t ready to overhaul systems without clearer, proven cases; they didn’t want to be beta-testers of overhyped tech.

However, the landscape is changing. Enterprise requirements can be met today: we see interoperability standards, better development tools, and clearer regulations in some jurisdictions. The overhyped expectations have been transformed into practical and achievable pilot projects. Essentially, the industry has done a much-needed “reality check,” and forward-thinking institutions are now making informed, cautious moves rather than being sidelined.

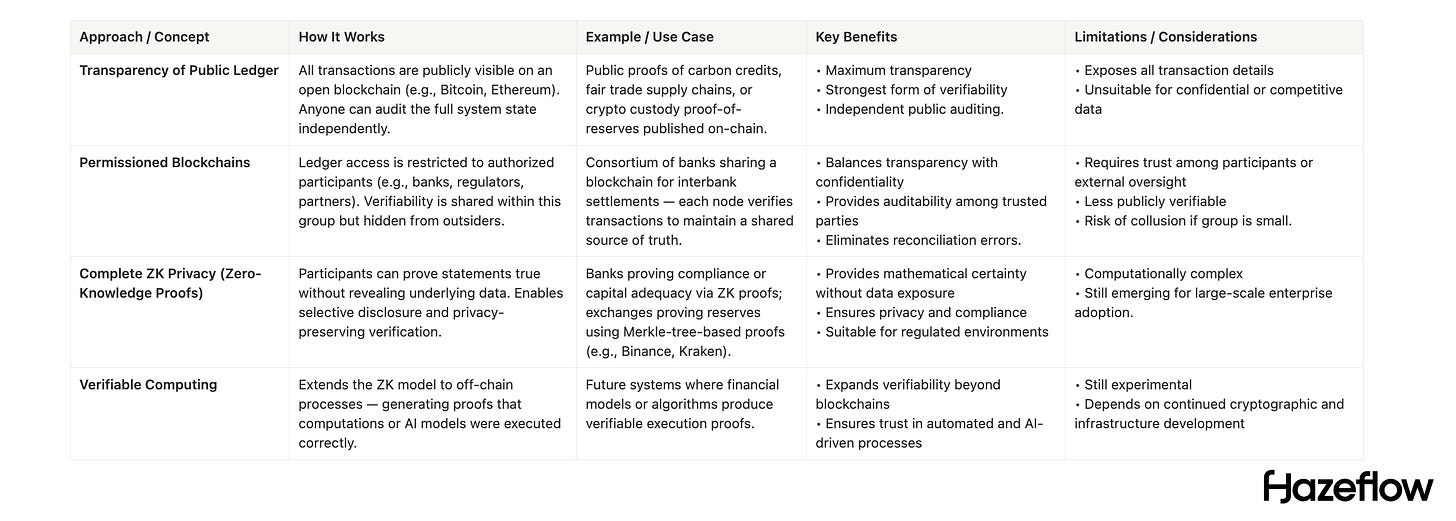

What are the suitables types of verifiability?

When we talk about verifiability, it’s not one-size-fits-all. Depending on an institution’s goals and constraints, different approaches can be used to achieve verifiable systems.

Stage 1. Transparency of Public Ledger

This is the classic blockchain approach (as with Bitcoin/Ethereum) where all transactions are publicly visible. It offers the strongest form of verifiability: anyone can independently audit the entire system’s state. This model is suitable when maximum transparency is desired or acceptable. For example, if a firm wants to prove certain data to the world (say, proving carbon credit issuances or demonstrating fair trade supply chain), publishing those transactions on a public blockchain lets any third party verify authenticity. Some institutions use this in limited ways, such as publishing proof-of-reserves for a crypto custody service on-chain.

Stage 2. Permissioned Blockchains

Here, verifiability is shared among an authorized group rather than the whole public. The ledger is only accessible to participants like the institution and its partners, regulators, and so on. This approach is aimed to balance transparency with confidentiality. All members can verify the data within the network, but the outside world cannot see the data.

Many enterprise blockchain projects adopt this model. For instance, a group of banks might run a shared ledger for interbank settlements: each bank node verifies every transaction, eliminating the need to trust each other’s separate records. The key is that within the group, you get a single-source-of-truth and auditability (It’s worth noting that if the group is small, outsiders must trust that the participants aren’t colluding, so this works best when members have mutual checks or external oversight).

Stage 3. Complete ZK Privacy

ZK (zero-knowledge) proofs let one party prove to another that a certain statement is true (e.g., “This portfolio’s risk metric is under X” or “User meets KYC criteria”) without revealing the data behind it. For institutions, ZKPs and similar proofs can enable selective disclosure. For instance, a bank could prove compliance with regulations or capital requirements by providing a cryptographic proof rather than opening all its books. This way, regulators or partners get mathematical certainty that rules are met, but sensitive details (like individual customer info) stay private.

Another example is proof-of-reserve audits for exchanges: exchanges have used Merkle-tree-based proofs to show users their funds are backed one-to-one by assets, without exposing everyone else’s balance.

It’s already increasingly used in the crypto industry. After the FTX collapse in 2022, many exchanges (Kraken, Binance, and more) implemented proof-of-reserves systems where anyone can verify the exchange’s asset holdings against customer liabilities. Going forward, we expect “verifiable computing” to grow, where even off-chain computations or AI models can produce proofs that they were executed correctly.

In practice, solutions often mix these approaches. A permissioned network might publish periodic zk proofs to regulators, while a public chain might use encryption and zk proofs to hide sensitive data yet allow selective verification. Verifiability lies on a spectrum: from fully transparent ledgers to cryptographically verifiable but opaque ones. Institutions can choose the mix that suits their risk, regulatory, and business needs.

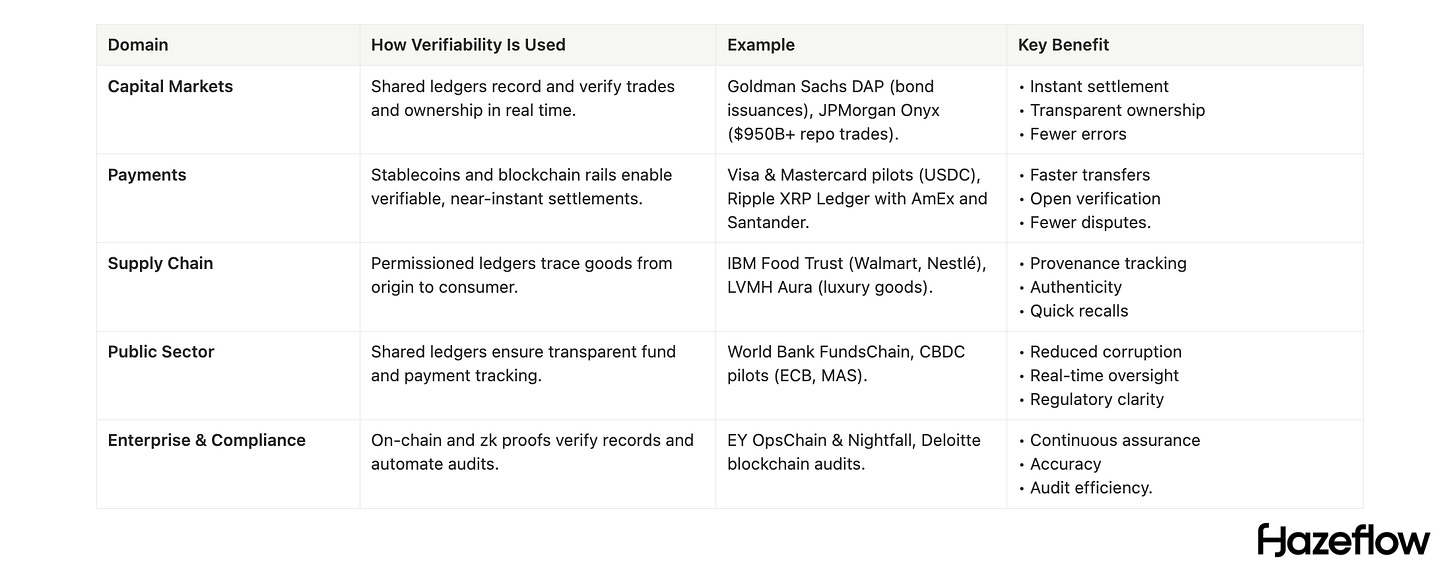

Which institutions implemented verifiability in some way?

Despite the challenges, some institutions have experimented with or implemented different types of verifiability in recent years. We wanted to understand when, why, and how they have done it and how different types of verifiability are applicable for different institutions.

Type 1. Capital Markets (implemented tokenized securities)

Broadridge Financial, Clearstream, and Goldman Sachs have used blockchain-based transaction platforms to eliminate process inefficiencies and increase participants’ trust in markets. These platforms create a shared ledger for trades (such as private stock placements or repo transactions), so all parties can verify the trade details and ownership in real time. Goldman Sachs’ digital asset platform (DAP) has facilitated bond issuances on a blockchain, enabling instant settlement and an auditable record of ownership changes.

JPMorgan’s Onyx network has been settling intraday repo trades on-chain (over $950 billion processed), where the system verifies collateral and ownership instantly, in contrast to the old overnight batch process.

Type 2. Payment Networks (implemented seamless cross-border transfers)

Visa and Mastercard have piloted using stablecoins on public blockchains for settlement between banks. One advantage is that a transaction settled via a stablecoin (e.g., USDC) on Ethereum comes with an open ledger entry; the banks involved can independently verify the payment completed and is final, within minutes, without relying on a SWIFT message confirmation that takes days. This is essentially bringing the verifiability of crypto transactions (which are atomic and transparent) to institutional money movement.

Another example is Ripple’s XRP ledger being used by some remittance providers (American Express, Santander, SBI Holdings): it allows all parties to track a payment’s path in real time, giving senders and receivers cryptographic proof of payment and reducing disputes.

Type 3. Supply Chain and Provenance

Outside of finance, verifiability can also be applied to supply chain tracking. One case is the IBM Food Trust network (with participants like Walmart, Nestlé, etc.), which uses a permissioned blockchain to trace food products from farm to store. Every step (harvest, processing, shipping) is recorded on the ledger. If there’s a recall or question, anyone with access can verify where a particular batch came from and where it went.

Likewise, luxury brands (e.g., LVMH’s Aura consortium) operate on-chain to let customers verify that a handbag or watch is genuine and trace its production journey. The shared ledger ensures data from different companies can be trusted.

Type 4. Public Sector

Government institutions are testing blockchain for transparency. The World Bank’s FundsChain initiative (piloted with certain country partners) is using blockchain to track development project funds. Each disbursement and payment in a project (say, building a school or hospital) is logged on a shared ledger accessible to stakeholders. It tackles corruption and mismanagement by making any “leakage” of funds immediately obvious on the ledger.

Another example is CBDC pilots: projects like those by the European Central Bank or Monetary Authority of Singapore have explored distributed ledger technology for interbank payments. A key motivation is that regulators could gain a verifiable view of all transactions in the system (with privacy protections in place). While most CBDCs are still in the R&D phase, the verifiability aspect is what makes the difference.

Type 5. Enterprise Data & Compliance

Big Four audit firms have been exploring on-chain mechanisms for audit and compliance verifiability. For instance, EY developed a blockchain-based platform for verifying enterprise transactions and even enabling zk proofs for private transaction validation (the EY OpsChain and Nightfall projects).

They have demonstrated how a company’s financial statements could be partially verified by matching against on-chain transactions and providing higher accuracy. Deloitte has also integrated blockchain into some of its audit processes (e.g., confirming the existence of clients’ crypto assets via on-chain verifications rather than paper statements). These efforts show the auditing industry recognizing that real-time verification can replace some laborious sampling and testing. In the future, auditors might check a zk proof for each transaction instead of trusting management records. It’s not widespread yet, but pilot programs suggest that continuous assurance is coming soon.

Each of these examples is early, but they indicate a trend: institutions are slowly starting to adopt verifiability where it adds clear value. They often begin in areas where trust issues or inefficiencies are most glaring, like finance, supply chains, and audits, and run controlled pilots.

When every party sees the same verifiable data, disputes drop and processes accelerate. As Gabe Otte, CEO of Dinari (a firm tokenizing an S&P index), said recently: “Financial systems depend on trusted data and transparent infrastructure… ensuring [an index] operates with integrity and verifiability on-chain.”

Looking Forward

In the first part of our “Institutional series,” we’ve explored the importance of verifiability of the actions of institutions.

As we continue this series, we will dive into other aspects of the Institutions x Crypto intersections, addressing how each part is the core for understanding the future of on-chain capital and the technologies backing it.

Thanks for reading!