Why Redistributing Tokens is Better Than Burning Them.

Exploring whether burning or redistributing slashed assets is better for the system.

Summary

We are considering whether burning or redistributing assets is better for a system to remain healthy with aligned incentives.

When slashing is the initial stage of punishing malicious behavior, redistributing the assets is usually a more efficient option than simply burning them.

When burning is a core feature of the design and slashing is not involved (such as with deflationary economics), there is no reason to implement redistribution.

When redistribution is a core feature of the design but seems more like a bug, there is no reason to replace it with burning, changes must be made at the foundational level.

Definitions

A lot of people seem confused and assume that when something gets slashed, the slashed stake is automatically burned and the supply is reduced. That’s not true.

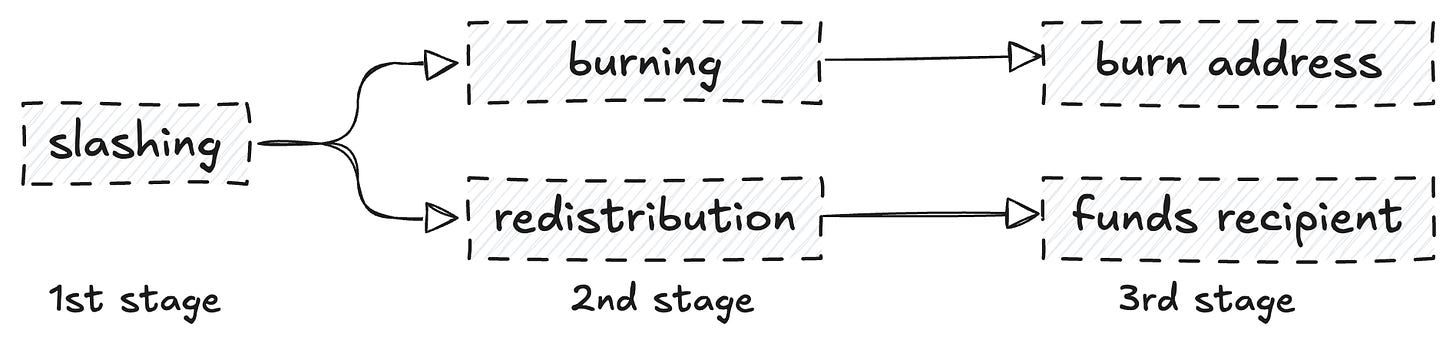

Slashing describes that assets are “taken away” from someone who is acting maliciously, while burning and redistribution describe what happens with the assets themselves after the assets have been taken away.

As we said before, they can either get burned or be redistributed: one action reduces the total supply, while the other one redirects value to another party (not always a hurt one). Burning can also happen without slashing due to the in-built mechanism design of the protocol.

Redistribution Contributing to Economic Security

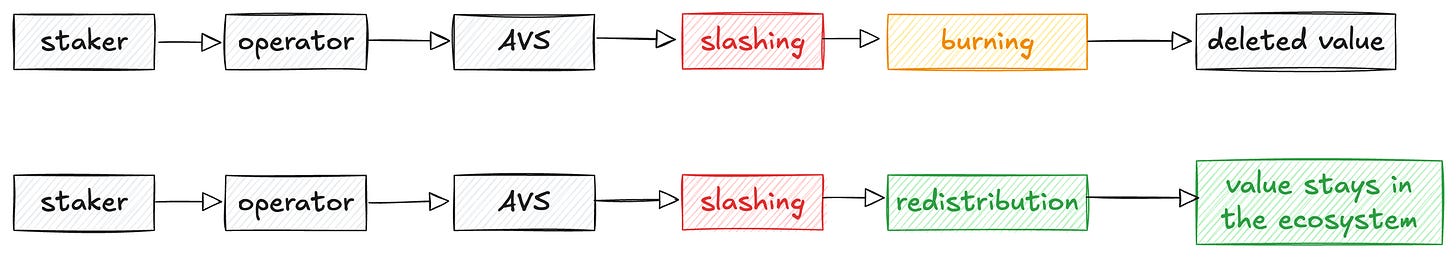

Let’s take one of the most well-known protocols in crypto today—EigenCloud. Here, operators get slashed for failing to fulfill their obligations, which is a good thing: bad guys receive bad treatment. However, before the introduction of redistribution of slashed funds, those funds were permanently burned (and can still be burned today).

We believe that burning slashed funds in such a system is like shooting yourself in both legs. When an operator’s stake is slashed, the operator gets punished (which happens for a reason), but:

Affected parties receive no compensation after they’re hurt (imagine you were hit by a car, the driver was imprisoned and punished, but you received no assistance).

The system becomes less secure (because now there are fewer assets securing the system).

So why should we burn the value and shoot ourselves in both legs when we can keep this value and route it to harmed parties? Reliable parties can increase the amount of rewards they receive, harmed users can be compensated, and value stays in the ecosystem; it’s just redirected. It can unlock a bunch of use cases for apps.

New types of on-chain insurance protocols that may work correctly in a permissionless way.

Faster, guaranteed DEX trades compensating traders if their request failed, expired, or wasn’t filled on time. More incentives for operators to operate honestly and transparently.

Protect lenders with guaranteed APR, more transparency, and a potential for native fixed rates.

Economic security can directly contribute to safeguarding users after an incident, not only before it as with a burning mechanism. Redistribution is already implemented in protocols like Cap, where slashed operators’ funds are redistributed to affected holders of cUSD.

It does not come without its downsides.

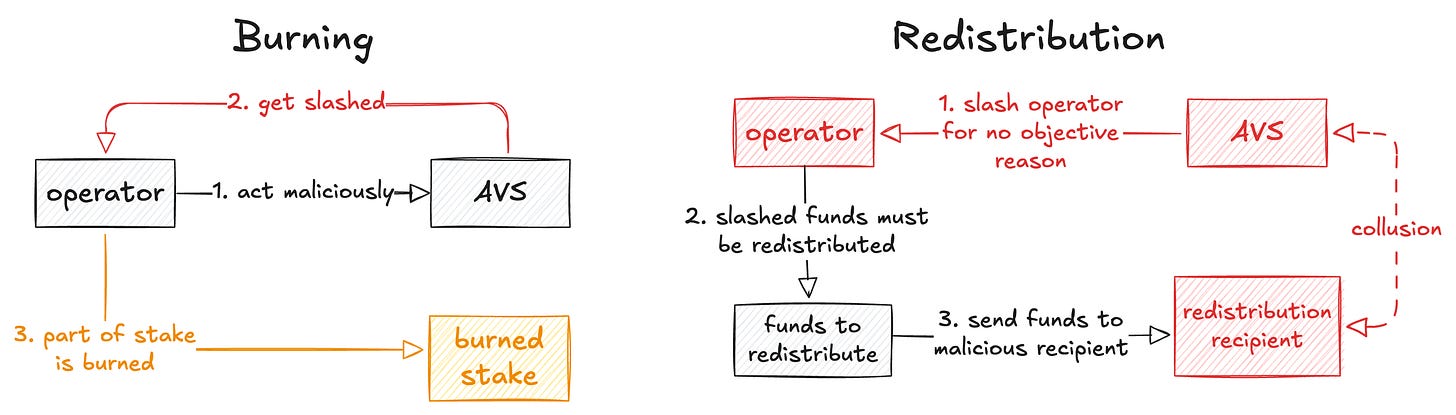

Burning assets is easier than redistributing because you don’t have to care what happens with the assets afterward; they’re simply burned, benefiting no one. There are fewer upsides and significantly fewer risks as well. With redistribution, the game changes drastically, and implementation (slashed from a bad guy → redistributed to a harmed party) is not as straightforward as it seems.

Malicious operators can now join forces with a malicious AVS. Currently, an AVS can implement any custom slashing logic it wants, even if it’s not fair or objective. With slashing, it doesn’t make much sense for an AVS to act maliciously, because operators won’t commit their stake if they know they may be slashed for no objective reason.

With redistribution, an AVS can drain one operator’s stake to a malicious one (they work together) to basically extract value from the system. The same thing happens if AVS keys are compromised, which can also affect the overall “attractiveness” of operators or AVSs.

Here, an additional evaluation of mechanism design is needed. Operators shouldn’t have a “switch type” option after they’re created. Instead, there should be a method to identify compromised (malicious) operators and re-redistribute value if it ended up in their hands, as well as constant monitoring, etc.

While burning funds would be much easier, redistribution is more fair, but it requires an additional level of complexity.

Fixing Bad Redistribution

Maximal Extractable Value (MEV) can be seen from a perspective where harmless users and LPs get slashed for no reason. When users want to swap assets, they can be either front-run or sandwiched, resulting in a worse output (prices).

We can confidently say that they’re getting slashed because they commit a stake (assets to swap) to the system (DEX), hold it for a certain period of time (swapping time), and end up receiving significantly less than they should.

There are two core problems here:

LPs get slashed for no reason (they didn’t act maliciously).

Users get slashed for no reason; they didn’t act maliciously and weren’t even intending to earn something or act well for the system, they just wanted their action to be performed.

Here, value is extracted and redistributed in a way that exploiters are rewarded, while parties that have done nothing wrong get slashed.

This problem is easier to fix for users by having certain sequencing rules (like Arbitrum Boost).

This problem is more complex for LPs, because they’re usually victims of LVR (loss-versus-rebalancing).

Can this be fixed with burning?

Burning can provide diffuse benefits to all token holders without specifically compensating those LPs who incurred direct losses from arbitrage activities. It could technically be fixed by burning, which would leave no incentive for arbitrage once the profit is burned.

However, once arbitrage profit is extracted, it’s significantly more difficult to identify such arbitrage: while on-chain trades are visible, CEX data doesn’t show the exact addresses of traders.

Poor redistribution design in this case can be fixed with app-specific sequencing, where LPs can capture value that would otherwise be lost to exploiters. This is one of the solutions implemented by Angstrom, and it is performing quite well.

In this particular MEV case, neither redistribution nor burning is a viable option; they only treat the symptoms, not the cause. Changes must be made at the foundational level.

Where Burning Might Be Better Than Redistribution

We want to outline that redistribution isn’t a magical pill that can always replace burning. When slashing (the first stage) isn’t involved, in most cases, burning funds is a key feature of a mechanism’s design.

We can take BNB as an example, where BNB tokens are burned quarterly, and it’s a core feature of this deflationary tokenomics model. Here, redistribution cannot be implemented because this is a process where neither exploiters nor harmed users are involved.

A similar process occurs in ETH’s design (EIP-1559), where base fees are burned, creating a deflationary effect. Considering Ethereum’s mechanism design, the fees can become very high during network congestion, and someone might argue that instead of burning, base fees could be redirected to a treasury fund that compensates for a portion of the fees during network congestion. However, there are more downsides than potential upsides:

Redistributing fees may dilute the deflationary effect and lead to higher inflation and potentially depressing token value over time.

Misallocation of funding and less revenue (how should the fund prioritize which transactions to sponsor? Does it make sense for a user to pay a priority fee when it can be compensated by funding? etc.).

It might be easier to spam and create even more congestion if you know your fees will be sponsored.

Hypothetical redistribution of Ethereum’s base fees to stakers could incentivize validators to prioritize high-fee transactions and ignore those that weren’t sponsored or paid in advance.

There are a bunch of other cases out there, but the main point is that redistribution is not a panacea. If burning happens on its own (without prior slashing), there is almost no reason to replace it with redistribution.

So?

Ultimately, we want to point out that redistribution usually performs worse than burning in cases where prior slashing isn’t involved, while in scenarios where slashing is involved, redistribution usually plays a better role than burning.

The problem of incentive alignment is a persistent issue in crypto and typically changes from one protocol to another. If the economic value directly contributes to the security or another crucial factor of the system, it would be better not to destroy this value, but to find a way to correctly redistribute it to those who act honestly, which incentivizes fairness and honest behavior.

Hazeflow is a blockchain research firm with experience in research, analytics, and the creation of technical, product, and educational materials.

We work with blockchain teams (especially complex-tech ones) who struggle to clearly and meaningfully explain their complex product.