Private Network Effects: Winner Takes It All

Single private blockchain can dominate the whole market due to strong network effects.

This article is about the network effects of private blockchains, which are way stronger than those of public blockchains. I’m sure that a single player can basically capture the whole market, and it’s way easier than it seems.

The key privacy player will have no competition at all for years to come and will become an industry standard that everyone will adopt.

I won’t explain why different users need privacy, because it is obvious. Everyone needs privacy — it’s a fundamental human right stated in many constitutions across the world.

I will explain how powerful private network effects are, and why there’s a high possibility of just one solution eating the whole pie.

How Private Network Effects Work

When you use a private blockchain (send some transactions), you’re actually locked into this chain. It’s similar to how public chains try to attract users and lock them into their ecosystem, but the incentives here are completely different.

Most acquisition mechanisms of new chains are financial: higher yields, earning points, farming rewards, etc. It’s a fairly easy method to acquire new users (who doesn’t like money?), but it’s also quite easy to game and max-extract value from users themselves.

Most public chains have nothing to offer besides financial incentives, so people join the chain → farm incentives → incentives are distributed → leave.

Users stay because of liquidity mining campaigns, not because of other users.

These mechanisms don’t have strong network effects, and there is almost no retention (which is justified because of financial motives).

In private blockchains, users might actually stay because of other users, because the data stays private if it doesn’t leave the blockchain (closed system).

The effect of saying “I’m transacting here privately” is more powerful than the effect of saying “I’m getting good yield here”.

I agree that good yield might sound more attractive in the short term, but there is absolutely no competition long-term. One product can be timeless, while the other one is like Clubhouse during COVID times.

When users choose a private blockchain, their choice matters much more than in public ones, because once they join one, they’re less likely to move and risk being exposed. This eventually creates a winner-takes-most scenario.

One privacy solution can dominate the whole market because of justified strong network effects without financial incentives.

As Ali Yahua from a16z said, privacy creates chain lock-in.

When you move from one zone to another, your data (even for a moment) ends up in-between those zones and can be targeted (more on that in the next section).

If enough users / participants / people join a certain private platform, it can very easily become a standard. Why? Because of network effects + developing permissionless private tech is more expensive (both in terms of time and money), there is less competition.

That’s why Solidity (EVM) became a standard — developing a new virtual machine and a programming language is expensive.

And that’s the same reason why Solana (SVM) became the strongest competitor — developers can use Rust, a language that already had established network effects.

An end-game private chain must be the destination: a platform where people are ready to hold their funds long-term and not bridge to other platforms. If participants use the chain just for a couple of transfers, it’s like a layover where people need privacy at a particular moment.

Private chains should always aim to become the destination where all actions (including the most significant ones) happen inside.

The platform will get a winner-take-most outcome, but an even more likely winner-take-all outcome in the end. A privacy chain can choose its specific dimension (like Bitcoin dominating “store of value”) and dominate very easily with private network effects.

There could be another player with a similar purpose (like what silver is to gold), but once a standard has been accepted by the majority and/or key players, there is no second-best option and absolutely no competition.

Messaging between private chains

Thank God we can say that we fixed interoperability. @debridge produces millions in daily bridging volume and LayerZero became a dominant messaging protocol between public chains.

I can bluntly say that now it’s “trivial” to move assets and other data from one chain to another as long as everything is public. You see, when we were exploring interoperability, the main concern was the same as Bitcoin’s — make it secure and avoid any fraud. We made it secure (despite a couple of exploits), but privacy was never part of the conversation.

Privacy was never part of the design of all modern interoperability protocols. In fact, messaging protocols don’t have to be private, or we will have Tornado Cash 2.0 and innocent founders will go to jail because DPRK will launder money there.

So there’s always a risk when you’re moving out of one zone to another: your transaction can be used against you, either via MEV exposure, congestion, address poisoning, and a dozen other things.

It doesn’t matter if it’s public <> public, public <> private, or private <> private connection, because bridges have to be transparent enough to track fraud activity. Bridges have to leak transaction timings, size correlations, and similar data.

I doubt we can really change that, but here is also an opinion from @fede_intern:

I also want to make it clear that the supremacy of a single private chain doesn’t eliminate the idea of app-specific chains. Sometimes apps are better off existing on their own rails, like Hyperliquid and Lighter.

But do you know any other examples?

Appchains are not in demand. As I mentioned earlier, new general-purpose chains often have nothing to offer besides financial incentives. Therefore, there is no reason to waste time figuring out privacy transfers between them, even though the private network effects thesis doesn’t conflict with it.

Private Foundation vs. Private Opt-In

Another argument that someone might make is that we don’t really need private chains; we can build privacy solutions on top of public chains. At the end of the day, institutions want to buy and sell crypto without people knowing what they’re doing.

As the guys from

mentioned, NVIDIA doesn’t want to tell everyone how much they transfer to Samsung, and a hedge fund doesn’t want to tell everyone exactly when they’re deploying capital.

At the same time, when your blockchain is completely private like Monero, where transactions are untraceable, you will very likely have problems with regulators.

Still, at the same time, blockchains like Zcash also don’t fit, because this selective privacy is not flexible enough. You can choose which transactions to make private, but you can’t choose which exact details to hide.

The definition of a private blockchain has changed over the years. It was first imagined as an invisible permissionless black box; now it’s more like a permissionless black box where you can color the parts you want. Just being private is not enough anymore — you want to be privacy-flexible.

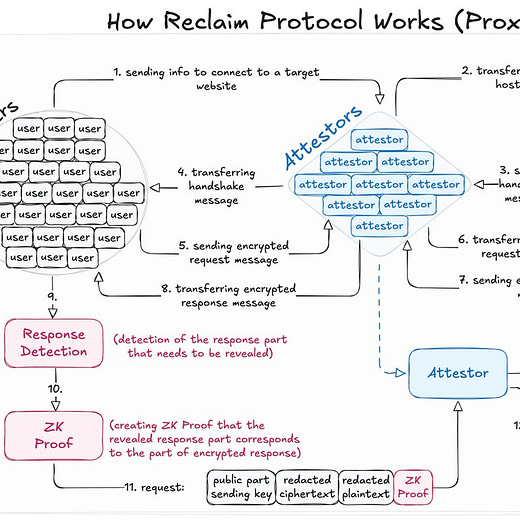

It’s also one of the reasons why zkTLS gained so much traction over the last year: you can import your personal (private) data into web3 and only disclose the specific details. If you want to buy alcohol, you prove you’re over 18 (or 21 in the land of freedom), with no need to disclose your exact age or show documents with way more data than needed.

If you’re curious about zkTLS, you can learn more here:

OP

Private Network Effects: Winner Takes It All

This article is about the network effects of private blockchains, which are way stronger than those of public blockchains. I’m sure that a single player can basically capture the whole market, and it’s way easier than it seems.

The key privacy player will have no competition at all for years to come and will become an industry standard that everyone will adopt.

I won’t explain why different users need privacy, because it is obvious. Everyone needs privacy — it’s a fundamental human right stated in many constitutions across the world.

I will explain how powerful private network effects are, and why there’s a high possibility of just one solution eating the whole pie.

How Private Network Effects Work

When you use a private blockchain (send some transactions), you’re actually locked into this chain. It’s similar to how public chains try to attract users and lock them into their ecosystem, but the incentives here are completely different.

Most acquisition mechanisms of new chains are financial: higher yields, earning points, farming rewards, etc. It’s a fairly easy method to acquire new users (who doesn’t like money?), but it’s also quite easy to game and max-extract value from users themselves.

Most public chains have nothing to offer besides financial incentives, so people join the chain → farm incentives → incentives are distributed → leave.

Users stay because of liquidity mining campaigns, not because of other users.

These mechanisms don’t have strong network effects, and there is almost no retention (which is justified because of financial motives).

In private blockchains, users might actually stay because of other users, because the data stays private if it doesn’t leave the blockchain (closed system).

The effect of saying “I’m transacting here privately” is more powerful than the effect of saying “I’m getting good yield here”.

I agree that good yield might sound more attractive in the short term, but there is absolutely no competition long-term. One product can be timeless, while the other one is like Clubhouse during COVID times.

When users choose a private blockchain, their choice matters much more than in public ones, because once they join one, they’re less likely to move and risk being exposed. This eventually creates a winner-takes-most scenario.

One privacy solution can dominate the whole market because of justified strong network effects without financial incentives.

As Ali Yahua from a16z said, privacy creates chain lock-in.

When you move from one zone to another, your data (even for a moment) ends up in-between those zones and can be targeted (more on that in the next section).

Ali Yahya

@alive_eth

·

Privacy will be the most important moat in crypto.

Why? Because secrets are hard to migrate.

Everyone is launching a new “high performance” blockchain lately. But these chains are hardly different from one another. Blockspace is functionally the same everywhere. And with

Show more

If enough users / participants / people join a certain private platform, it can very easily become a standard. Why? Because of network effects + developing permissionless private tech is more expensive (both in terms of time and money), there is less competition.

That’s why Solidity (EVM) became a standard — developing a new virtual machine and a programming language is expensive.

And that’s the same reason why Solana (SVM) became the strongest competitor — developers can use Rust, a language that already had established network effects.

An end-game private chain must be the destination: a platform where people are ready to hold their funds long-term and not bridge to other platforms. If participants use the chain just for a couple of transfers, it’s like a layover where people need privacy at a particular moment.

Private chains should always aim to become the destination where all actions (including the most significant ones) happen inside.

The platform will get a winner-take-most outcome, but an even more likely winner-take-all outcome in the end. A privacy chain can choose its specific dimension (like Bitcoin dominating “store of value”) and dominate very easily with private network effects.

There could be another player with a similar purpose (like what silver is to gold), but once a standard has been accepted by the majority and/or key players, there is no second-best option and absolutely no competition.

Messaging between private chains

Thank God we can say that we fixed interoperability.

produces millions in daily bridging volume and LayerZero became a dominant messaging protocol between public chains.

I can bluntly say that now it’s “trivial” to move assets and other data from one chain to another as long as everything is public. You see, when we were exploring interoperability, the main concern was the same as Bitcoin’s — make it secure and avoid any fraud. We made it secure (despite a couple of exploits), but privacy was never part of the conversation.

Privacy was never part of the design of all modern interoperability protocols. In fact, messaging protocols don’t have to be private, or we will have Tornado Cash 2.0 and innocent founders will go to jail because DPRK will launder money there.

So there’s always a risk when you’re moving out of one zone to another: your transaction can be used against you, either via MEV exposure, congestion, address poisoning, and a dozen other things.

It doesn’t matter if it’s public <> public, public <> private, or private <> private connection, because bridges have to be transparent enough to track fraud activity. Bridges have to leak transaction timings, size correlations, and similar data.

I doubt we can really change that, but here is also an opinion from

:

I also want to make it clear that the supremacy of a single private chain doesn’t eliminate the idea of app-specific chains. Sometimes apps are better off existing on their own rails, like Hyperliquid and Lighter.

But do you know any other examples?

Appchains are not in demand. As I mentioned earlier, new general-purpose chains often have nothing to offer besides financial incentives. Therefore, there is no reason to waste time figuring out privacy transfers between them, even though the private network effects thesis doesn’t conflict with it.

Private Foundation vs. Private Opt-In

Another argument that someone might make is that we don’t really need private chains; we can build privacy solutions on top of public chains. At the end of the day, institutions want to buy and sell crypto without people knowing what they’re doing.

As the guys from @tiger_research mentioned, NVIDIA doesn’t want to tell everyone how much they transfer to Samsung, and a hedge fund doesn’t want to tell everyone exactly when they’re deploying capital.

At the same time, when your blockchain is completely private like Monero, where transactions are untraceable, you will very likely have problems with regulators.

Still, at the same time, blockchains like Zcash also don’t fit, because this selective privacy is not flexible enough. You can choose which transactions to make private, but you can’t choose which exact details to hide.

The definition of a private blockchain has changed over the years. It was first imagined as an invisible permissionless black box; now it’s more like a permissionless black box where you can color the parts you want. Just being private is not enough anymore — you want to be privacy-flexible.

It’s also one of the reasons why zkTLS gained so much traction over the last year: you can import your personal (private) data into web3 and only disclose the specific details. If you want to buy alcohol, you prove you’re over 18 (or 21 in the land of freedom), with no need to disclose your exact age or show documents with way more data than needed.

If you’re curious about zkTLS, you can learn more here:

Anyway, this type of selective and flexible privacy is only possible when the foundation (blockchain) was designed with privacy in mind. So in most cases, privacy on public chains is questionable.

Pseudonymity, security, trustlessness — yes. But not privacy in essence. It doesn’t matter if some liquidity pool is private if ramps, vaults, and actions before and after this private element are public.

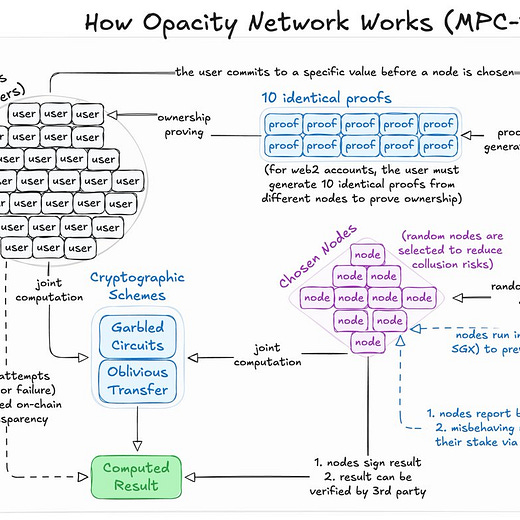

The conversations about whether private blockchains should use TEE, MPC, FHE, or ZK are pointless as well, because there will always be smart people on all sides advocating for their side.

Moreover, we can combine these technologies together to create better designs.

Their trade-offs are unrelated and can be compensated.

For example, MPC can replace hardware keys and serve as a key management service for TEEs.

The general-purpose foundation must be some combination of privacy and high-throughput to capture the whole market and open opportunities for everyone to participate (users and developers). Some solutions already exist today (I will mention them in the next sections), but there’s obviously still a long way to go.

The future of DeFi cannot exist without foundational infrastructure of selective privacy. At the end of the day, privacy protocols on top of public chains often treat the symptoms, not the cause.

Public chains lost their edge

Blockspace has become excessive. Well, it’s excessive for simple and moderate operations, but if we take all the blockspace of all blockchains in the world, it still wouldn’t be enough to launch something like DoorDash or Uber just in LA.

Blockspace is like an infinite pool that we will never fill, but at the same time you cannot put a shark here (that’s one of the reasons why companies like @eigencloud gain a lot of traction). Blockspace doesn’t differ anywhere, so there is nothing to compete on for public chains.

Blockchain fees are trending towards zero, tech is pretty similar, but at the same time very different everywhere.

However, it doesn’t change the fact that people stopped caring — we rarely see discussions anymore about whether based rollups, native rollups, or validiums will win.

General-purpose rollups are having a tough time. Debates are over and they weren’t even settled.

What do public chains compete on now?

Developer tools, funding, speed, support, ecosystem vision? Maybe, but all of that can be unified into a single term — the best network effects. Bitcoin, Solana, and Ethereum have already established strong network effects.

Private network effects are way stronger than public network effects, so in this dimension, I don’t think there is competition. Now, anyone can spin up a fast chain, subsidize fees for some time, attract temporary liquidity, and exit, just like Movement, Eclipse, or Blast. Network effects didn’t last there.

Public blockchains attract network effects to crypto as a whole, while private blockchains attract network effects only to themselves.

Secrets aren’t supposed to be transferred

Ali Yahya said that bridging secrets is hard. True, but also what’s true is that secrets are not supposed to be bridged or shared.

Secrets are valuable. When you tell multiple people your secret in real life, it’s not a secret anymore — it’s public knowledge. Private things become public very quickly, but public things rarely become private.

We’re not supposed to move secrets, so the opportunity for a closed system (private blockchain) to flourish and dominate the field is practically unmatched. It will be the combination of encrypted store of value, programmability, and obviously verifiability.

I imagine scenarios with confidential transfers on public chains (similar to shielded pools on Zcash), but I hardly imagine huge, blooming privacy-preserving infrastructure built on top of public chains.

How should private platform look like?

Well, this question is pretty easy to answer. The platform must be built with compliance in mind. And if we have compliance in mind, we have to make sure that the platform is permissionless, so it has to be a decentralized L1 (not like Ripple) or a non-financially motivated L2 (not like Base).

What happens if critical financial infrastructure is operated by people who are legally obligated to generate financial value for stakeholders? Nothing good, for sure.

The only viable option is a permissionless open-source blockchain which has no one to satisfy (legally). It’s needed to build trust. The only way to build trust today is to make sure that people who support the infrastructure can’t extract profit from it whenever they want.

That is even more critical for a private chain, because the value can be extracted not only from manipulating the transactions, but also from manipulating the information inside these transactions (data confidentiality).

If institutions and participants adopt something like this on-chain, it will serve as a universal source of truth just like permissionless blockchains today, but with reduced transparency and the ability to control what information to disclose.

Legal risks, margins, large orders, and information safety — everything can be protected and verified.

Who are the candidates for winning?

The winner will allow everyone to have confidentiality: positions can remain private, participants can remain anonymous (not pseudonymous like right now), and the exact logic of a particular transfer will not be observable. Liquidity will flow like lightning, while the containers remain dark.

There won’t be any tradeoffs like there were before — no compromises in UX, high-throughput, and overall usability. The winning chain will have highly flexible privacy on-demand, but designed as a private chain from the ground up.

I don’t believe Monero or Zcash will take the stage, simply because they don’t have native smart contracts. Both blockchains are used by privacy enthusiasts, but it’s time for new players to shine.

Now we have a few candidates: Aleo, Seismic, Canton, Aztec, and Miden. I will not analyze each chain (this part will be longer than the whole article), but I can say that each of them can win. Well, some of them are already winning.

Canton Network has the biggest traction so far, and honestly, it seems like they’re ahead of everyone at the moment.

Miden is unproven yet, but technically impressive.

If the Ethereum roadmap shifts more towards privacy, Aztec might win.

Aleo can win developers with Solidity.

Seismic can eat the market share of Canton with a16z support and a background in fintech.

Anything can happen and no one knows who will dominate or where the exact moment will be when we can say “yeah, they won”. It will come with time, and what’s left for observers is to observe and what’s left for builders is to build.