Flying Tulip: Using Yield Instead of Fundraising

A New Crypto Fundraising Model That Uses Yield to Fund Operations and Protects Investors with Perpetual Put Options.

1. Spending fundraising money is slaying your cash cow

Unfortunately, in most projects, tokens are used solely as a fundraising tool with no real utility. Therefore, the team often sells the tokens to fund operational expenses, incentive programs, liquidity mining campaigns, and so on.

That practice greatly influences the token price and raises FUD (fear, uncertainty, and doubt) within communities when the team sells tokens. Take the Ethereum Foundation as an example: when they sell ETH, the community accuses them of dumping.

Instead, the fundraising amount can be reinvested into low-risk strategies, and the yield from it should be enough to cover operational costs until the product starts making revenue.

2. Alternative Flying Tulip Vision

The core idea behind Flying Tulip is to use fundraising as a cash cow instead of simply spending the principal. Rather than directly spending the fundraised money, the team can deposit it to earn yield and use that yield to fund initial protocol operations.

The idea is that a team should have no tokens at all at the beginning. If they haven’t started earning revenue, the company shouldn’t be worth anything. Token ownership should align with real revenue, making it more milestone-based than it is right now.

Investing, and venture investing in particular, is an asymmetric bet: you can gain 1000×, but you can only lose 1×. However, VCs usually “spray and pray” across tens or even hundreds of deals and often lose money; that’s part of the game.

The Flying Tulip idea also comes with a form of downside protection, so at worst, investors can get their original investment back.

Therefore, the core idea of Flying Tulip is to raise a lot of money and not actually spend it, only using the yield from that money to fund operational expenses and buy back its own token.

3. Core Value Flow

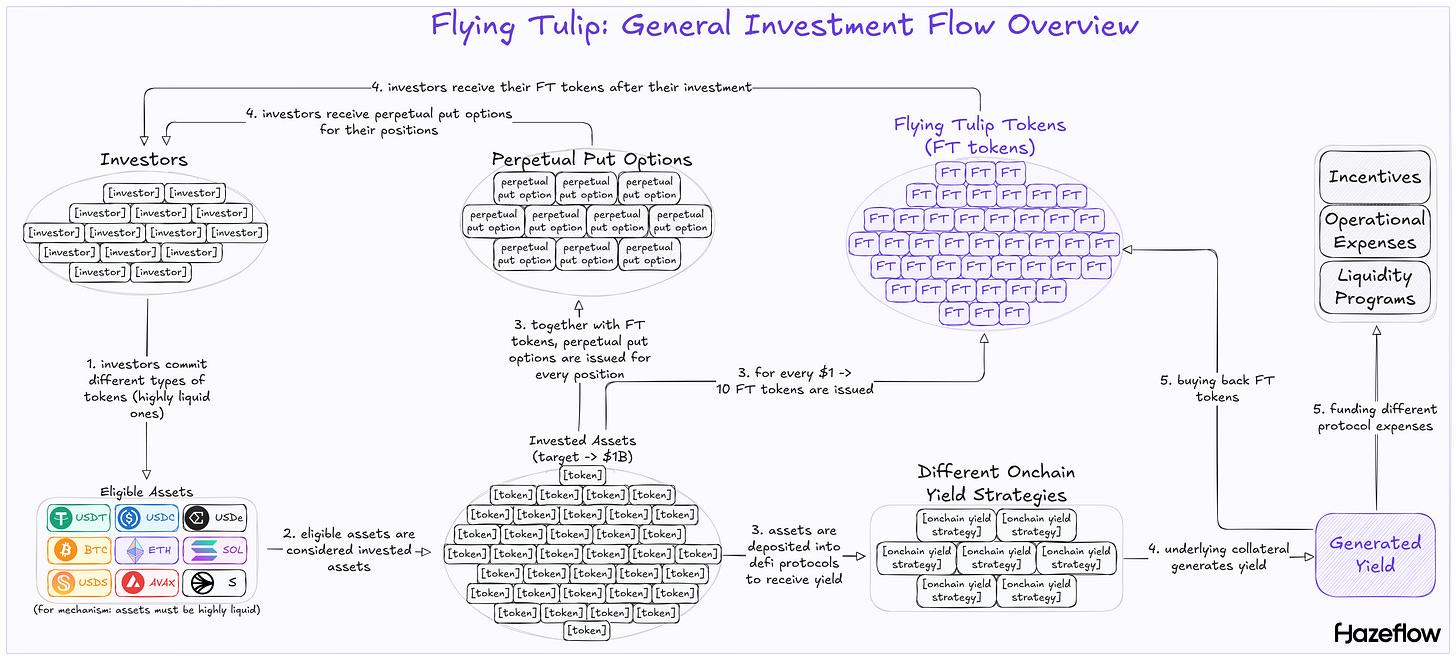

Investors commit different types of highly liquid tokens.

These tokens act as backing capital for FT tokens.

FT tokens are issued alongside perpetual put options for every investor’s position.

Investors receive their FT tokens and perpetual put options.

Invested capital is deployed into multiple DeFi protocols to farm yield.

Generated yield is used to buy back and burn FT tokens, increasing token scarcity.

Generated yield is also used to fund different protocol expenses.

4. What is a perpetual put option?

First of all, perpetual futures (perps) and perpetual options are not the same thing.

Perpetual futures are ongoing contracts that let traders bet on an asset’s price changes without an end date. Profits or losses increase or decrease steadily with the price, and small fees are paid periodically to keep the contract aligned with the real market price.

Perpetual options give traders the choice (but not the obligation) to buy or sell an asset at a set price forever. They have uneven profits that can limit losses for buyers, including upfront fees and possible changes to the set price over time.

There are two types of options: a put (the right to sell) and a call (the right to buy). In the context of Flying Tulip, a perpetual put option is issued along with FT tokens, which means that investors can sell their tokens at any point in the future for their initial investment.

For example, if an investor buys 1000 FT tokens worth $10, they can sell their 1000 FT tokens at any point in the future, even if those 1000 FT tokens are worth less. It’s worth adding that put options will be tradable on their own and so there will be an open market for them where the price of put options will highly likely correlate with the price of FT tokens.

Having a perpetual put option equals being protected from assets losing their value.

5. If the team has no tokens at TGE, how are they getting them?

At the beginning, investors own 100% of the supply, and the team owns nothing. In fact, the team owns nothing until they start making money, providing an incentive for the team to make their protocol profitable.

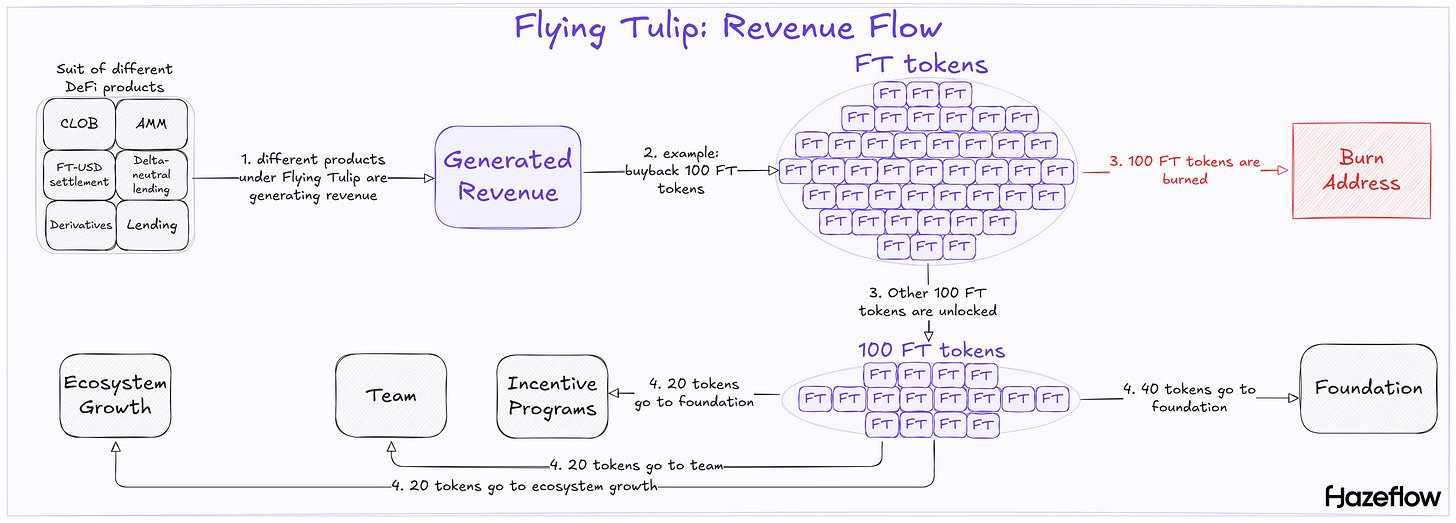

Let’s assume the suite of different DeFi products is generating revenue. 100% of this revenue is used to buy back and burn FT tokens. At the same time, the same amount of tokens is unlocked for the team and distributed among the foundation, incentive programs, ecosystem growth, and the team itself. You can see the exact proportions in the diagram below. Revenue and fees should eventually contribute to the buy pressure of FT.

6. Why are only stablecoins, BTC, ETH, SOL, and AVAX can be a backing capital?

The put option is a core feature of the protocol. If assets are tied up in illiquid positions, the protocol risks being unable to meet redemption demands, especially in stress scenarios and when faced with the risks outlined below. The PUT is asset-specific. For example, if investors contributed USDC, they must be paid in USDC, not in other currencies. Therefore, high liquidity must be maintained for each type of asset. Funds cannot be reallocated to higher-yield opportunities because the received yield from those opportunities could be in other types of assets.

First, this is why only highly liquid assets can be backing capital. Second, that is why highly liquid assets are deployed in highly liquid strategies (stablecoins in Aave, ETH in stETH, SOL in jupSOL, and so on).

7. What happens when I sell / transfer my FT tokens?

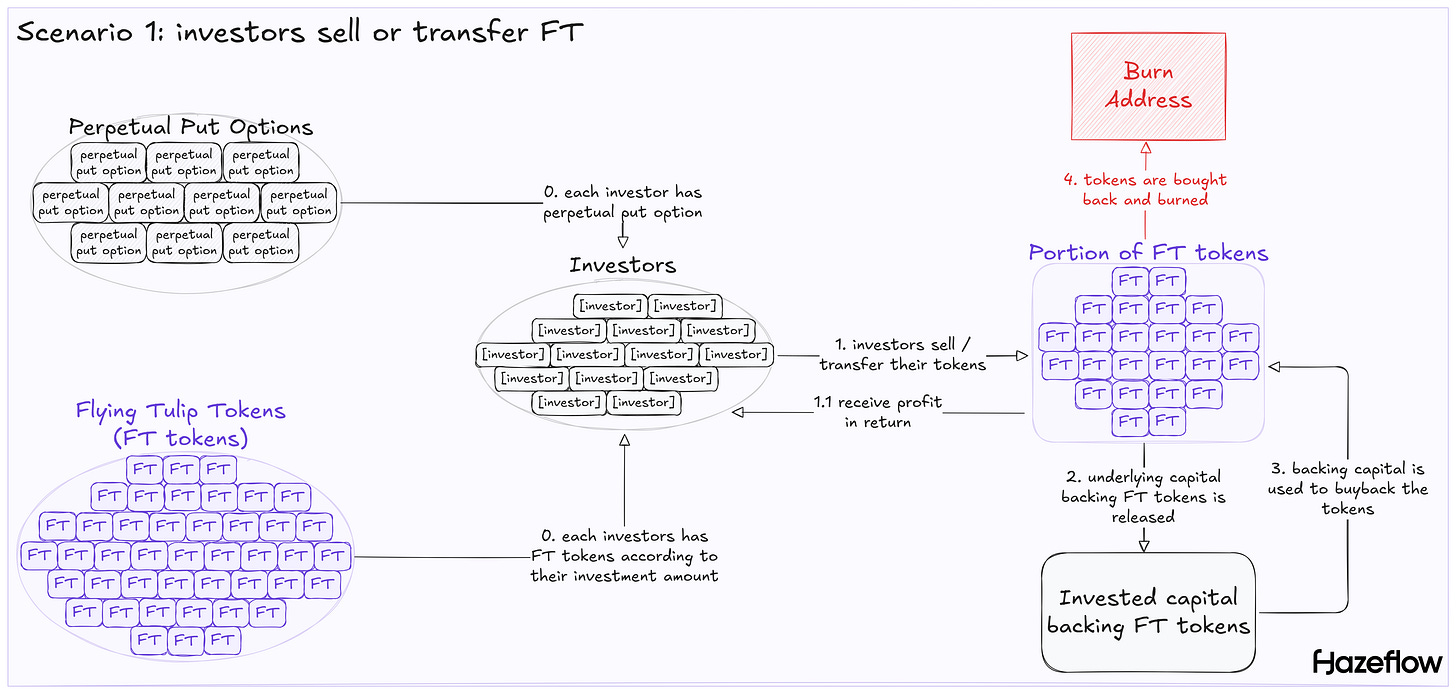

If investors transfer or sell tokens, their put options become invalid or void.

Let’s say an investor spent 100 USDT to buy 1,000 FT tokens. When they sell their tokens (or a portion of them), they receive 100+ USDT (assuming the investor has an incentive to sell and not exercise their option).

Those initial 100 USDT (the backing capital of 1,000 FT) are released and used to buy back the FT tokens and burn them, reducing the total token supply.

An investor purchases 1,000 FT tokens by paying 100 USDT (1 FT = 0.1 USDT).

Investors selling 1,000 FT tokens receive 110 USDT (1 FT = 0.11 USDT).

100 USDT of the initial backing capital is released.

100 USDT are used to buy back 909 FT (1 FT = 0.11 USDT).

Those 909 FT are burned, the supply is reduced, and token scarcity is increased.

When investors sell, they always make some profit; otherwise, there is no reason to sell (you can always get back your investment without losses). When tokens are sold, it influences the price, depending on how many tokens are sold. Buying back and burning tokens is the action used to compensate for the price drop and decrease the volatility from selling by buying tokens and burning them, thus reducing the supply.

8. What happens when I exercise my put option?

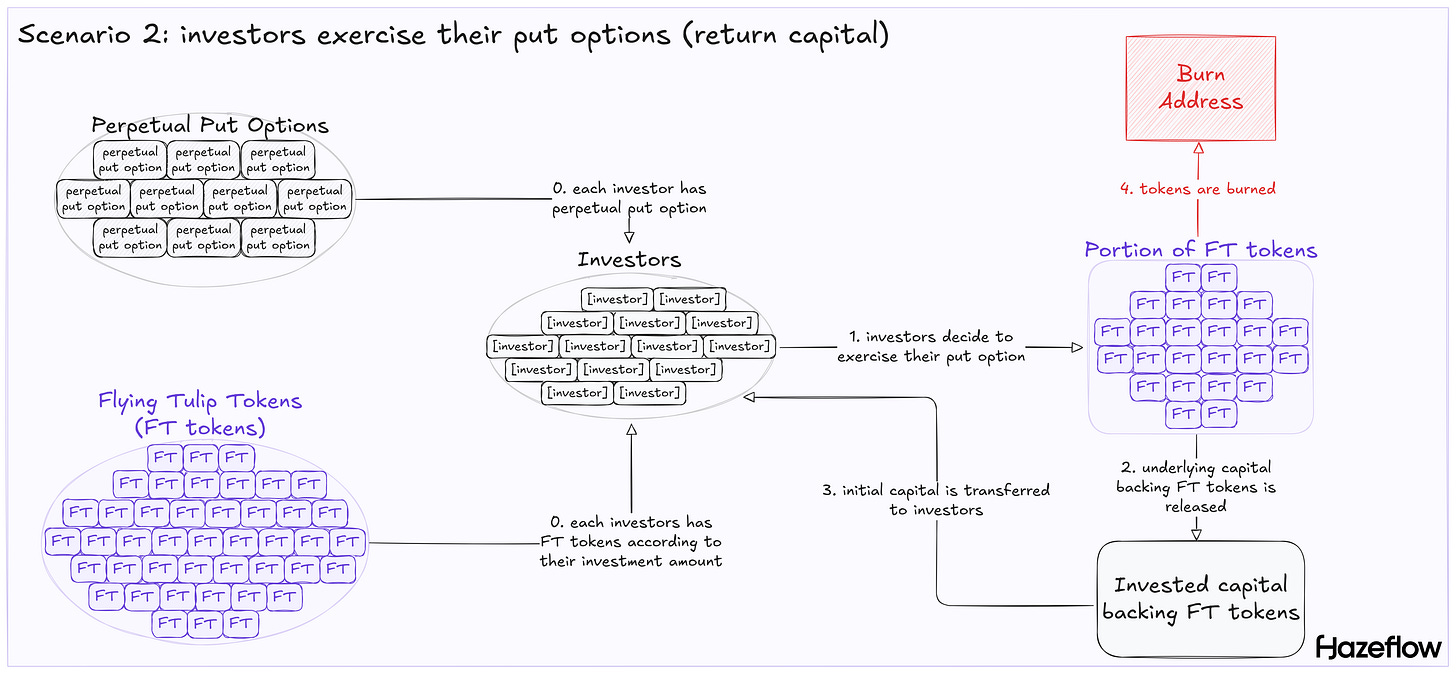

The investor can exercise their option at any point because it is perpetual. Investors only have an incentive to exercise their option if the current cost of their tokens is lower than or equal to their initial investment amount.

Obviously, when investors want to sell for profit, they would not exercise their option because it makes no sense. Thus, put options are only exercised when investors want to sell their tokens for their original investment without incurring any losses.

In this case, the initial capital is returned to investors, and the tokens are burned. In terms of value flow, exercising an option and selling for profit are similar: in the first scenario, tokens are burned, and in the second scenario, they are bought back and burned. In fact, no matter what investors do, their actions contribute to reducing the supply.

9. What are the risks of this model?

I want to divide types of risks into two categories: general risks and model-specific risks.

Among general risks are those that are present in most DeFi products. We must take into consideration the stability of the stablecoins and pegged assets used as backing, because most assets will receive yield from staking. Assuming that USDe is one of the core assets of backing capital, putting it into staking with sUSDe presents even more risks, as these are sensitive to market funding rates. Yield could become negative or insufficient to cover perpetual put option redemptions.

In this case, the protocol will take the losses, and the downside protection promised by the PUT mechanism could be undermined.

Obviously, with the majority of backing capital being stablecoins (mostly USDT and USDC), there are regulatory and legal risks. However, it is fair to say that if that occurs, it will affect the industry in general, not just Flying Tulip.

The model-specific risks are more interesting, especially with Flying Tulip’s demand for “immediate liquidity” and delays in the transaction supply chain. The problem is that staking positions involve unbonding periods or withdrawal queues. On Ethereum, there could be delays due to the network’s validator exit queue for stETH. Withdrawal queues are more dangerous than the ETH unstaking queue because the capital has underlying risks for many different protocols which are being used for yield.

If there is a large number of correlated PUT exercises, delays will be an issue when redemptions require same-day liquidity. This could cause investors to panic and exercise their options, covering potential losses and adding even more instability to the system.

10. Opportunity costs

If the price of FT remains close to the initial $0.1 for a long period of time, the FT value stagnates. Holders do not realize capital gains, and their investment is locked in a low-volatility asset without momentum, so it does not make sense for them to participate at all. They could have simply deposited it somewhere else, as depositing USDC on Aave could yield similar returns.

In Flying Tulip, the backing assets could earn similar yields on their own. These yields indirectly support FT holders by funding buybacks, which could stabilize or modestly increase the token’s value over time, but it is not that simple.

However, if the price remains the same, the return for holders mirrors what they might earn from holding and yielding stablecoins directly without the added benefit of significant appreciation. This is because buybacks at these levels primarily maintain the floor value rather than generate outsized gains.

11. So what’s the product? Is it only a raise mechanism?

This is a very interesting part. If you have read this far, you might be wondering that the whole article has been about the fundraising mechanism, but what about the actual product? It seems this model can be implemented everywhere, but what is the actual product besides the fundraising mechanism? How is revenue going to be generated?

There are no clear details at the moment about the specific product, but the team wants to build an entire DeFi super app from it, featuring its own stablecoin (ftUSD), delta-neutral lending markets, delta-neutral derivatives, insurance, an on-chain CLOB (Central Limit Order Book), a permissionless AMM), lending, and permissionless derivatives. The FT token will be integrated natively, and revenue from those products will be used to buy back and distribute yield to users (in addition to funding its own operations, obviously).

12. Where does the Flying Tulip name come from?

This is the question that I was particularly interested in because “Flying Tulip” by itself made no sense, so I asked the team about it.

Flying refers to the Flying Dutchman.

Tulip refers to the Tulip Mania.

The Flying Dutchman (the ship doomed to sail forever) contributes to volatile crypto markets that are doomed to be volatile yet remain open and permissionless (like the seas). Moreover, Andre Cronje is Dutch himself (technically South-African, but if you know history, you know about Dutch in South Africa).

Tulip Mania represents a speculative bubble in the Dutch Republic where the prices of rare tulip bulbs soared due to intense trading and then crashed dramatically. This is one of the greatest financial lessons and one of the world’s financial heritages.

Flying Tulip equals Andre’s heritage plus the world’s financial heritage.

Hazeflow is a blockchain & crypto research firm focused on underlying technologies, product approaches, and functions of blockchain products.

Written by Pavel Paramonov.