Everyday App Framework: Why, after 15 years, crypto hasn't shipped its everyday app

Introducing a "Everyday App Framework" and finding out why crypto hasn't shipped its everyday app after 15 years since inception.

It’s been 15 years. Trillions of dollars have poured in. Entire sectors rebranded. Wall Street, Silicon Valley, and global regulators took notice.

And yet… not a single crypto app has become part of everyday life for the masses.

Nobody wakes up and checks their favorite app. Nobody messages friends over a wallet-native chat. Nobody sends $5 to a friend onchain like they would on Venmo or PayPal.

How did we build an industry this big, this loud, this well-funded — without shipping a single everyday app?

Let’s rewind

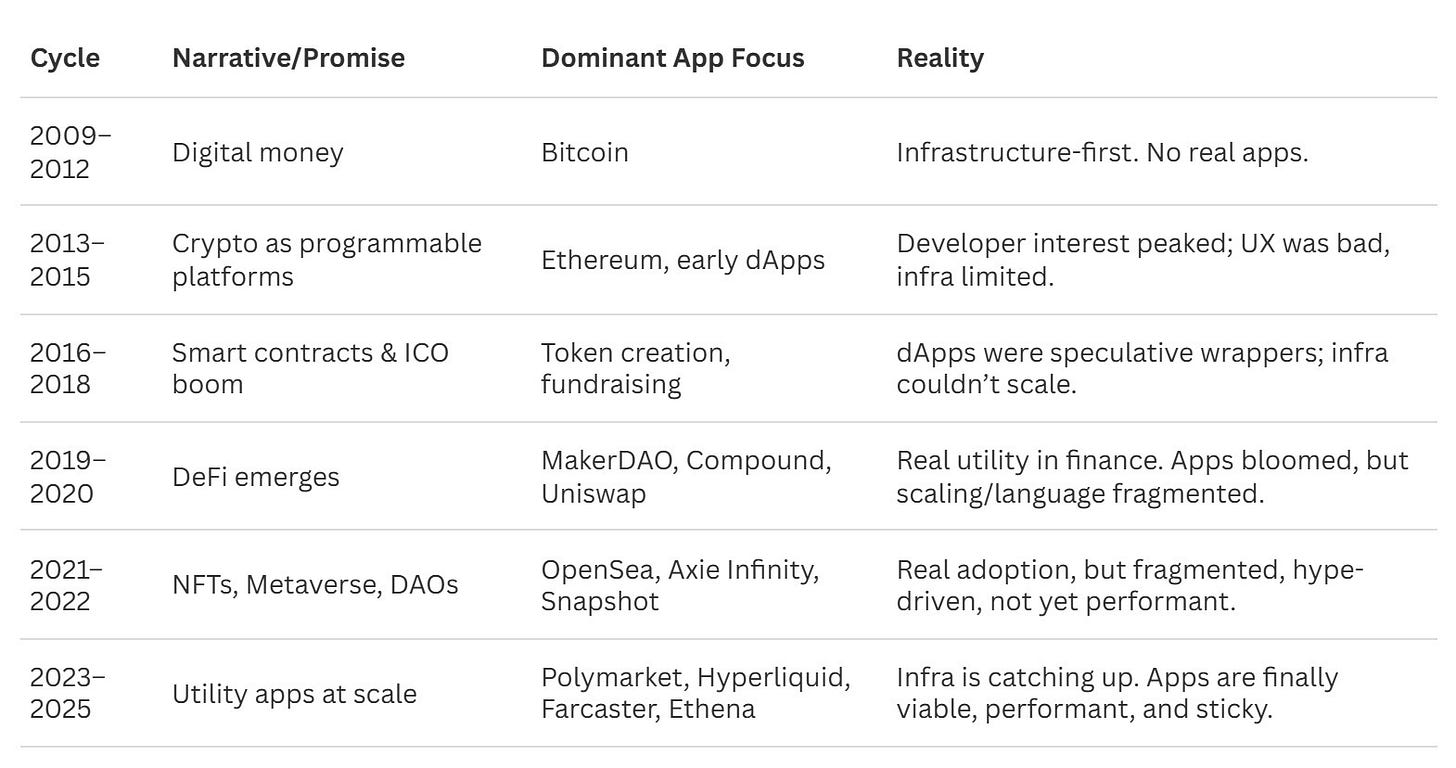

For most of the time in it’s brief history of 15 years, crypto focused on building core infrastructure — blockchains, consensus systems, wallets, bridges, oracles, and financial primitives. This long “infra phase” is not accidental. Decentralized systems, to succeed, had to first match or exceed the performance, reliability, and flexibility of their centralized counterparts.

That meant the first 10–15 years of crypto were primarily about proving concepts: money without banks (Bitcoin), code as law (Ethereum), DeFi, and tokenized ownership (NFTs). But even as these concepts of dapps emerged, they were limited by scalability, latency, and complexity.

However, today, the ecosystem is visibly shifting. Thanks to scalable blockchain, performance-heavy crypto applications are finally entering the foreground — apps that start to rival web2 usability and speed. The era of crypto infrastructure is transitioning into the era of crypto utility.

We’re starting to see the first signs of real on-chain usage.

Stablecoins like USDC, USDT, lead in daily transactions, making TradFi payments look slow and expensive.

Memecoins, once pure speculation, now act as liquid, programmable social currency.

Polymarket is proving that prediction markets can scale with real money and real data.

High-performance DEX like Hyperliquid is going toe-to-toe with centralized exchanges by abstracting away crypto’s complexity.

Though still early, these all hint at a broader cultural shift.

How Everyday Mobile Apps and Websites Evolved Through Time

Early 2000s

Before smartphones, mobile experiences were fragmented and mostly functional. In the early 2000s, apps were limited to essentials like calendars, ringtones and Java-based games. Opera Mini (2005) brought the “full web” to feature phones, while Google Maps Mobile introduced interactive navigation.

Distribution was messy — there were no unified app stores, just carrier portals, manufacturer hubs like Nokia’s Download!, or independent sites like GetJar. Internet speeds were slow (2G), data was expensive, and most users stuck to what came built-in, just like crypto’s state today.

Late 2000s and early 2010s

That changed dramatically with the iPhone’s launch in 2007 and the introduction of the App Store in 2008. For the first time, there was a centralized, global marketplace for mobile applications. Early apps like Facebook, Gmail, Google Maps, and WhatsApp quickly became part of daily routines.

WhatsApp, in particular, saw explosive growth in countries where SMS was expensive, using its utility and network effects to become a messaging staple. Mobile habits were forming: users opened the same apps multiple times a day, not just for function but for connection.

By 2013, smartphone adoption reached critical mass globally, unlocking a new wave of everyday mobile apps. Ride-hailing and food delivery apps like Uber and Doordash became routine, not luxuries. Uber’s model especially showed the power of tight feedback loops: more drivers reduced wait times, attracting more riders, which then pulled in even more drivers. This two-sided network effect mirrors the promise of decentralized physical infrastructure networks (DePINs) where more contributors improve the experience for all users, turning infrastructure into a living, user-powered system.

Meanwhile, mobile payment systems like Apple Pay and regional giants like WeChat Pay and AliPay made digital finance effortless. Many of these apps integrated deeply with mobile OS features, like contacts, payments, and notifications, making them indispensable and hard to switch from.

2016 and onwards

From 2016 onward, mobile usage shifted from utility to dopamine. Short-form video apps like TikTok transformed phones into endless entertainment portals. What started as a niche rapidly scaled into a global cultural wave — TikTok grew from 50 million users in 2018 to 1 billion in 2021.

These weren’t just apps; they were “new tings” — novel user experiences that captured attention and rewired behavior. Its addictively short videos formed a new kind of habit loop, forcing platforms like Instagram and Facebook to launch their own versions (Reels, Stories).

Today, mobile apps are deeply embedded into global culture and infrastructure. Meta’s suite — Facebook, WhatsApp, Instagram — touches over 3 billion people daily. Regional leaders like WhatsApp in India or WeChat in China thrive by adapting to local norms and regulations

Apps that serve essential human needs like communication, transportation, payments, and entertainment have proven the most enduring.

The core success factors haven’t changed:

Strong network effects

Intuitive onboarding

Platform-level integration (e.g., pre-installs, OS-level sharing)

Habitual value creation.

Increasingly, the winners are entire ecosystems, not just apps.

Differences Between Crypto Apps and Traditional Everyday Apps (Web2 vs. Web3)

In traditional landscape, developers spent years chasing the “killer app” — the single product that would drive mass adoption. But in reality, ubiquity came slowly, as smartphones themselves became more widespread.

Crypto, by contrast, has followed a very different path.

The longest surviving players — Bitcoin, Ethereum, Uniswap, Aave, ENS, The Graph — are not consumer-facing apps, but foundational infrastructure. They are protocols, not platforms.

In fact, if giants like Google or Meta evolved from apps into ecosystems, crypto’s leading projects started as ecosystems and are still waiting for mass-market apps to emerge on top of them.

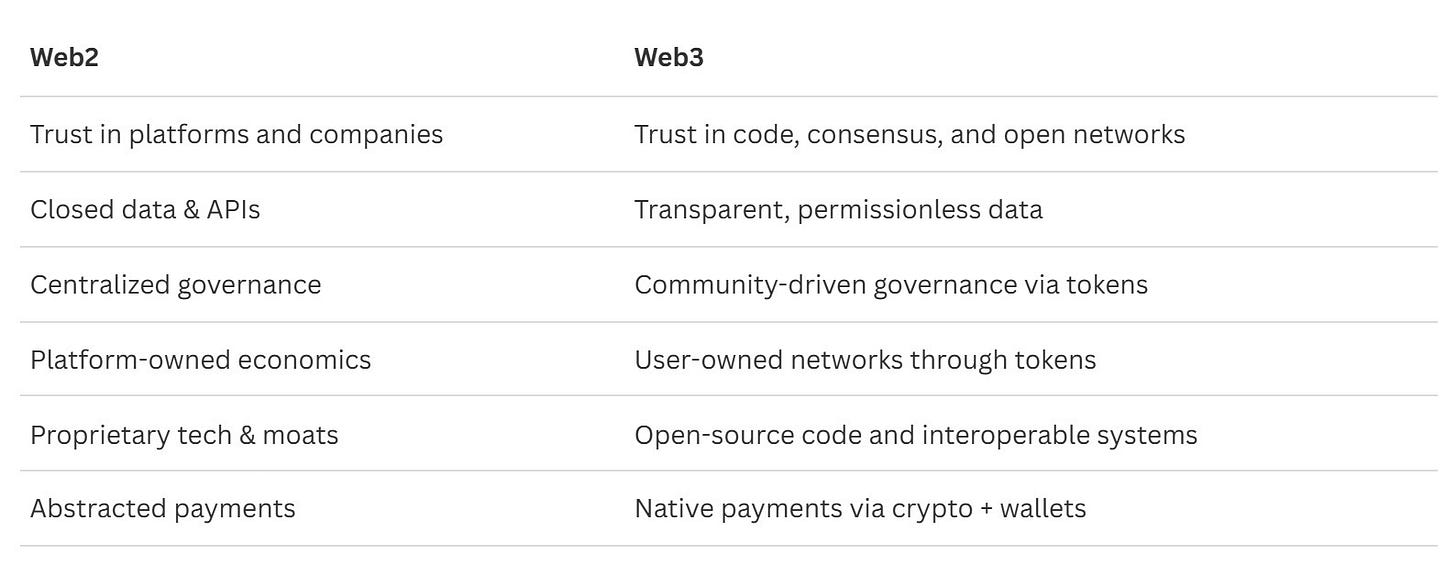

This highlights the core divergence: Web2 built visible apps that became platforms, Web3 built invisible protocols still waiting for their killer apps.

At the root of this divergence are a few structural and philosophical differences:

These architectural differences introduce both advantages and frictions.

Wallets (the core identity) offer user ownership and payment capabilities, but also introduce UX complexity.

Interoperability means users can carry assets or credentials across ecosystems, but also makes onboarding and security more difficult to abstract away.

Open data enables innovation and composability, but removes traditional moats and forces new kinds of defensibility.

Let’s now expand on what Web3 offers differently at a deeper layer — not just in ideology but in technical and economical structures that shape the kind of apps it enables (or struggles to).

What Web3 Provides That Web2 Doesn’t (and Why It Matters)

1. Transparent Public Data

Most activity on a blockchain is publicly available. This allows any developer to build analytics, forks, or competing interfaces. It shifts defensibility away from “data moats” toward “experience, network, and trust.”

Example: anyone can build a Uniswap frontend or analyze all OpenSea trades without API keys.

2. User-Level Data Sovereignty

Web3 offers privacy by design using tech such as ZK, TEE, MPC, etc. and in theory, users can choose to monetize or share their own data. This unlocks a new paradigm where users are stakeholders — not products. Wallets act as persistent identity across apps, with control over what data is shared, when, and with whom.

3. Token-Based Governance

Instead of central product teams deciding roadmaps, Web3 apps can be governed by token holders — often the users themselves. While still an emerging model, this allows for app direction to reflect community priorities (e.g., Uniswap's fee switch or ENS treasury decisions). Governance is both a right and an incentive.

4. Composability & Interoperability

Web3 apps are built to be modular and open by default. Assets, logic, and identity can move freely across protocols. This means developers can remix and interoperate across ecosystems (e.g., an NFT in one game used as a DeFi collateral in another). It also means protocols compete on being pluggable rather than monopolistic.

5. Wallets as the Core Interface

Every Web3 app connects to a wallet which handles identity, authentication, and payments in one. This is a profound shift. Instead of logging in with email or phone, users bring their log in and their assets into unified experience. It also introduces friction (seed phrases, gas, wallet switching), but offers unmatched ownership and portability.

6. Payments & Ownership Are Native, Not Add-ons

Every Web3 app is natively integrated with value transfer. Unlike Web2 apps, where payments are abstracted through third-party processors (Stripe, Apple Pay), crypto apps settle transactions instantly via the chain. Even actions like voting or file storage can involve micro-payments and token incentives, blurring the line between user and participant.

Despite these differences, the goal remains the same: to create everyday apps that users return to naturally. Whether it’s built on a blockchain or not, an app needs certain universal qualities to become part of a user’s daily life:

Retention & Habit Formation: app becomes a part of users’ daily or weekly routines — they return frequently without needing to be reminded.

Network Effects with Freshness: the more people use the app, the more valuable it becomes. Ongoing content, interactions, or utility keeps it sticky.

Daily Utility Fit: it solves a basic, recurring need — like messaging, payments, transport, entertainment, or information access.

Effortless Onboarding: users quickly reach value with minimal steps. Optional identity, intuitive flows, and clear purpose help lower friction.

Platform Visibility & Boost: the app benefits from built-in distribution — OS integrations, App Store rankings, or pre-installs increase discoverability.

Localization & Cultural Adaptation: it adapts to language, payments, and cultural contexts in each market to truly scale globally.

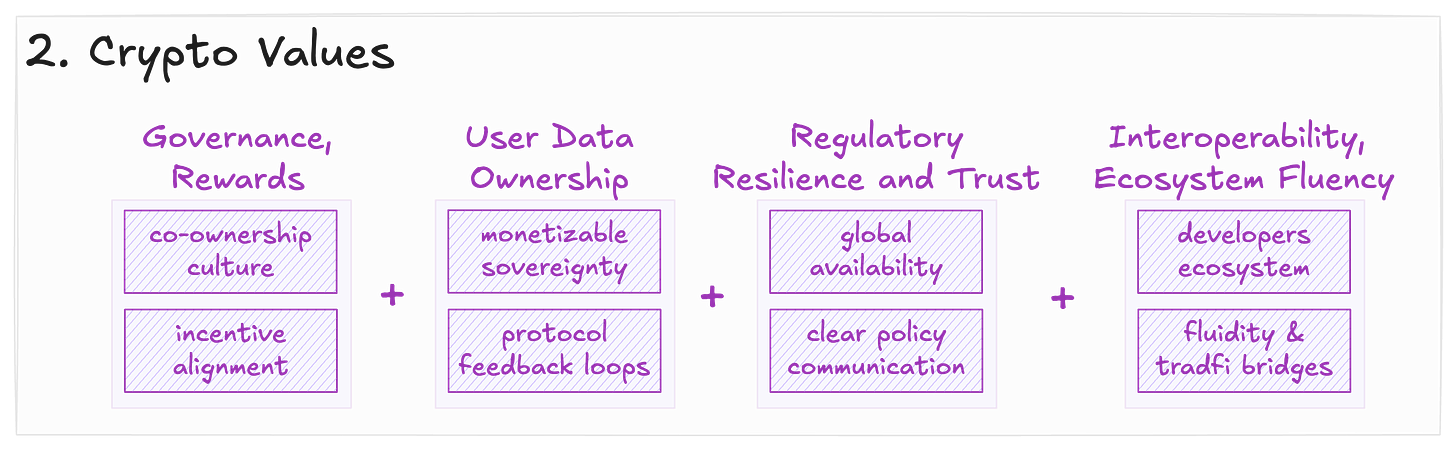

However, web3 apps need to be evaluated on additional, crypto-native dimensions.

Introducing Everyday App Framework

To become a true “everyday app,” a crypto product must achieve habitual usage, social traction, and seamless UX while leveraging its unique Web3 advantages like ownership, governance, interoperability, and data sovereignty.

This framework focuses on qualitative markers that reveal when an app is becoming deeply embedded in user routines and community culture.

This is divided into 25 criteria divided into four categories:

Pre-Usage (how users get to the app)

During Usage (how users feel after using the app for some time)

Post-Usage (users coming back after using it)

Crypto Values (additional parameter)

Each criteria is scored from 0 to 3, based on observed performance:

0 = Poor / Absent

1 = Minimal presence

2 = Moderate / Inconsistent

3 = Strong / Core feature

Then, each section is normalized to 10 points for equal weight in the total score.

Rating crypto apps according to the framework

The most popular examples of applications close to being an everyday crypto app are Stablecoins, Polymarket, Pump.fun, Hyperliquid, and Farcaster.

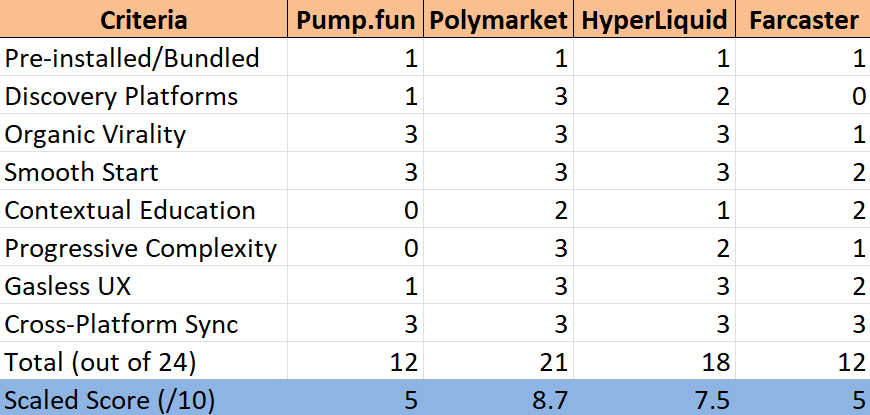

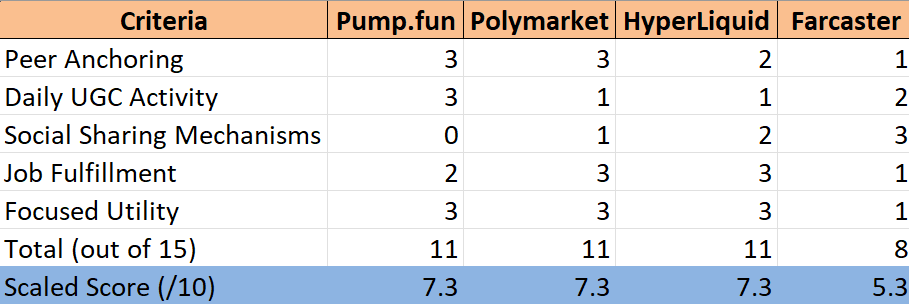

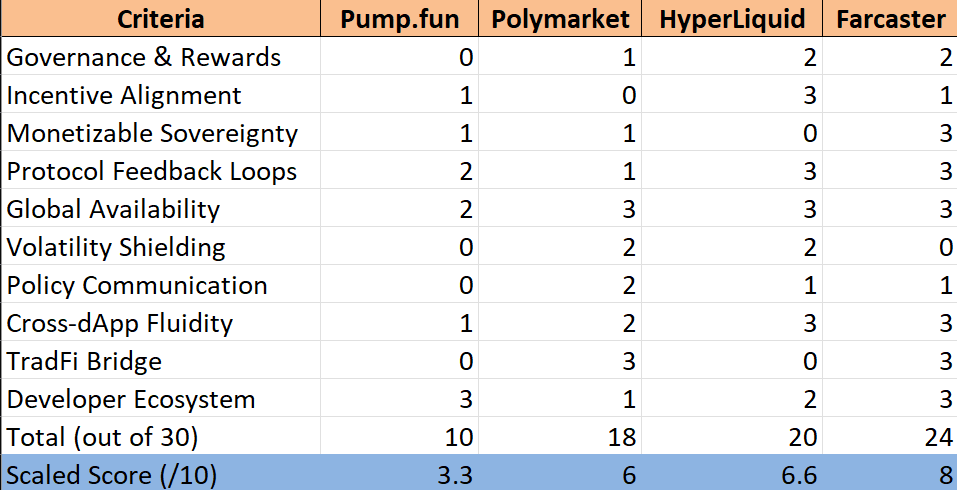

Let’s take a look at a score of all 4 of the above apps using the “Everyday App” framework across the four stages. Each section has been scored qualitatively (0–3), followed by a brief summary:

I. Pre-Usage

II. During Usage

III. Post-Usage

IV. Crypto Values

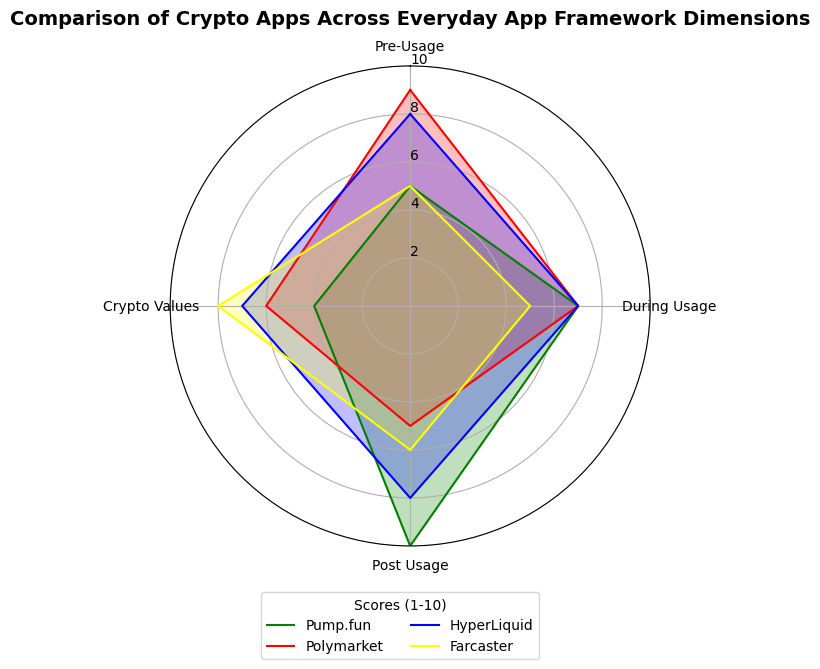

V. Results

Pump.fun: While it's addictive and excels at its core function, it scores low on Web3 values like governance and composability.

Polymarket: Its excellent onboarding and clear purpose make it a standout, but it struggles with long-term retention and user co-ownership. It's a great product, but not yet a daily habit.

Hyperliquid: It scores highly across the board: from smooth, gasless onboarding to a sticky trading experience. While governance is weak, it's the closest thing to a sleek, mainstream trading terminal in crypto today.

Farcaster: While its current user experience is niche and complex, it excels in crypto values, with a rich ecosystem and strong decentralization ethos.

These examples show that crypto is no longer just about infrastructure. Projects are now being used at scale, solving real problems, and reaching new users with practical, end-user-focused products. The infrastructure is good enough — what gets built on top is what matters now.

Infra-Time Is Ending: The Age of Apps Has Begun

For most of crypto’s history, space has focused on infrastructure. It had to — the technical performance of decentralized systems lagged far behind centralized ones. But that era is coming to a close. We're now entering the app phase, where crypto-native utilities are starting to match, and sometimes exceed, traditional experiences in performance, scale, and simplicity.

We're seeing a fundamental shift in crypto's user experience.

In 2024 alone, stablecoins facilitated 600 million transactions for over 28.5 million users, proving their utility in global payments.

Polymarket's simple funnel — sign in with Google and deposit USDC — drew in nearly 1 million new users during the U.S. elections.

Pump.fun's memecoins like TRUMP and MELANIA onboarded millions, with Chainalysis reporting that 50% of these holders were first-time users with less than $1,000 in assets.

Hyperliquid provides low-latency trading, while Coinbase's Base network has onboarded 25 million addresses by removing common pain points like seed phrases and complex gas fees.

The integration of TON with Telegram's massive user base is driving a new wave of crypto adoption. While its gaming mini-apps may be simple, their emotional and viral appeal is significant.

These aren’t just apps — they’re signals that the end-user experience is finally taking priority over pure protocol innovation.

The Biggest Unlock Here — Simplicity

Buying TRUMP didn’t require understanding consensus algorithms or liquidity pools. It was just: get a wallet, swap some SOL, and join the fun. The best crypto apps now start with the end-user and work backwards. They're frictionless, emotionally rewarding, and context-aware.

The Everyday App Framework helps us look past hype and into habit — to ask whether an app resonates on a human level. It tracks the pulse of user behavior: social traction, intuitive onboarding, cultural stickiness, and Web3-native traits like data sovereignty, governance, and interoperability.

The apps that will define crypto’s next chapter won’t just mimic Web2. They’ll feel native to the new internet which is emotionally compelling, radically simple, and built with user ownership at the core. Web3 gives users superpowers: they don’t just use the app, they own part of it, shape its direction, and carry their assets and identity across platforms.

We may not have found the killer app yet. But the groundwork is finally getting in place and the next breakout won’t come from deeper protocols, it will come from building for people, and giving them tools to build alongside you.

This is beyond beautiful!

For a while, I have studied similar structures/patterns and I agree with everything shared here: the Everyday App framework gives some higher form of clarity – one that I've been searching for.

In the last 5-6 months, I've shared my observations on;

• How infrastructure giants should focus on building apps on themselves (I wrote an article on the subject matter)

• How Web3 products do not retain their users because they do not build products that, when used make the user "care about themselves" (this was coined from the idea that humans are only care about themselves, and that means one must make using their product –for the user– mean caring about themselves too)

Finally, I made a short tweet on X(formerly twitter), on how the next wave of products that would win in Web3 are the ones that expand and turn into ecosystems.

See here: https://x.com/Pascal_x0/status/1953201769900642500

I'm quite glad that someone else sees the pattern and is able to express it so clearly.

I can only imagine the amount of work it took to put this together, so I commend and appreciate the work!