Crypto cards don't have any future

You read this right, we won't use them soon.

My general thesis is that crypto cards are a temporary solution to the problem that we all know — two problems, to be exact: bringing crypto to the masses and making sure crypto is accepted as a payment method worldwide.

Crypto cards are still cards, and if someone has true crypto values and believes in a future dominated by cards, you might want to rethink your vision.

All crypto cards companies will eventually die

Crypto cards will most likely die long-term, but not traditional ones. Crypto cards add another layer of abstraction: it’s not a pure crypto use case. Card issuers are still banks. Yes, they have a different logo, different design, different UX, but as I said before, it’s abstraction, and abstracting makes things function differently and more conveniently for the end user, but the processes stay the same.

Different L1s and rollups are obsessed with comparing their TPS and infrastructure to Visa and Mastercard. And it has been a goal for years: the goal “to replace” or if you’re more contrarian “to dethrone” Visa, Mastercard, AmEx, and other payment processors.

This goal is not possible with crypto cards — they’re not a replacement, they bring even more value to Visa and Mastercard.

They are still critical gatekeepers, and they wield the authority to set any rules and define their compliance standards, etc.

Most importantly, they retain the option to ban your card, ban your company, or even ban your bank if they decide to do so.

How come the industry that has always aimed for permissionlessness and decentralization now wants to hand all of that over to payment processors?

Your card is Visa, not Ethereum.

Your card is a traditional bank, not MetaMask.

You spend fiat, not crypto.

Most of your favorite crypto card companies don’t do anything besides slapping their logo on the card, and that’s it. They just ride on narratives, they won’t be around in a few years, and digital cards issued until 2030 won’t function until then.

I will explain later in this writing how easy it is to make your own crypto card these days — in the future, you can even make your own!

Same issues + more fees

The best comparison I’ve managed to come up with is app-specific sequencing. Yes, the idea that apps can navigate their own transactions and profit from it is cool, but this is temporary: infrastructure costs are going down, communication is maturing, and the economic problems are a layer higher, not lower.

(Here is a good talk about ASS by @mvyletel_jr, if you’re interested).

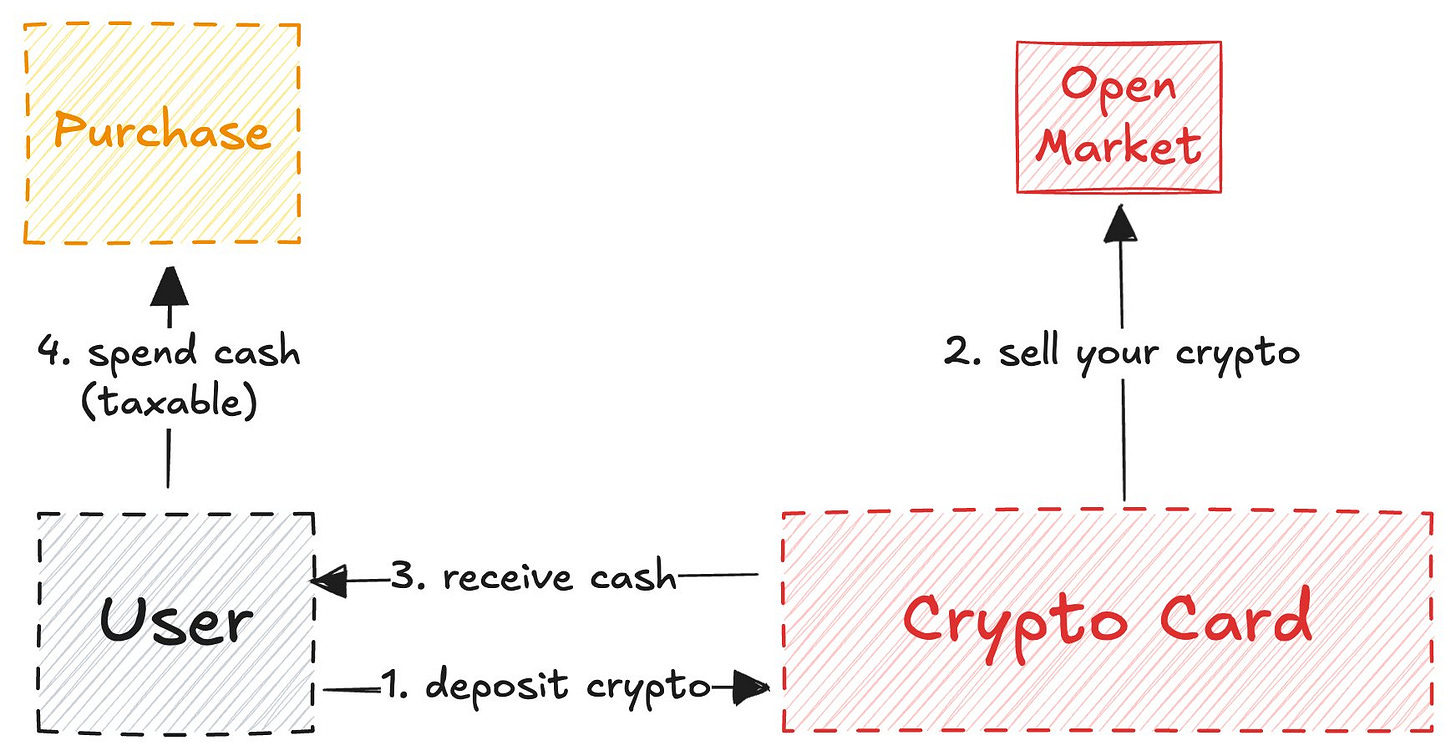

Same with crypto cards: yes, you can deposit crypto and your card will convert it to fiat so you can pay, but centralization and permissioned access are still issues.

It certainly is helpful temporarily: retailers don’t need to adopt new payment methods, and crypto spending is kind of invisible.

But this is just another step toward what most crypto believers want:

Need: paying with your stablecoins, Solana, Ethereum, Zcash directly

No need: paying with USDT → Crypto Card → Bank → Fiat indirectly

Adding one more layer of abstraction adds one more layer of fees: spread fees, withdrawals, transfers, or even custody yields sometimes. It might seem insignificant to you, but hey, it’s compounding: a penny saved is a penny earned.

Using a crypto card doesn’t mean you’re unbanked or bankless

Another thesis that I’ve been observing is that people think they’re unbanked or that they go bankless if they’re using a crypto card.

Of course, that’s not true. Under the crypto card label, there is a bank, and the bank is required to send information to its local government about you. Not all data, of course, but at least some of it.

If you’re an EU citizen or resident, the government knows your interest earned on bank accounts, large suspicious transactions, certain investment income, account balances, and more. If the underlying bank is American, they know even more.

Surprisingly enough, that is both good and bad from a crypto perspective.

It’s good in terms of transparency and verifiability, but the same rules apply if you use a standard debit or credit card issued by your local bank.

It’s bad because it’s not anonymous or pseudonymous: banks still see your name, not an EVM or SVM address, and you still do KYC.

Restrictions are still present

You might say that crypto cards are great because they’re really easy to set up: you download the app, complete KYC, wait for verification for 1–2 minutes, top up crypto, and you’re good to go. Yes, this is honestly a killer feature in terms of how easy and convenient it is, but it’s not accessible to everyone.

Russia, Ukraine, Syria, Iraq, Iran, Myanmar, Lebanon, Afghanistan, and half of Africa — citizens of those countries are not eligible to use crypto for their daily spending if they don’t have residency in another country.

But hey, those are just 10–20 countries that are not eligible for most crypto cards, what about the other 150+ countries? It’s not about the majority who are eligible — it’s about crypto values: a decentralized network of equal nodes, equal access to finance, equal rights for everyone. This is not present in crypto cards because they’re simply not crypto.

Max Karpis broke it down perfectly here on why “neobanks” are designed to fail at first.

For reference, the real time I actually paid with crypto was when I booked my flight tickets on Trip.com. They recently added an option to pay with stablecoins, so you pay straight from your wallet, and of course, it’s accessible to every single person in the world.

Here, it is a real crypto use case and a real crypto payment. I believe that the endgame will look exactly like this: wallets will improve UX specifically for spending and payments, or, less likely, they will become crypto cards (if crypto payments are adopted in some way or another).

Crypto cards function similar to a liquidity bridge (Rain)

Another interesting observation that I’ve made is that self-custodial crypto cards function similarly to cross-chain bridges.

This applies only to self-custodial cards: CEX cards are not self-custodial, so Coinbase and other exchanges have no obligation to make people delusional by saying that their funds are under users’ control.

One good use case of CEXes, and CEX cards in particular, is that they serve as a good source of proof of funds for governments, visa applications, or similar activities. When you use a crypto card attached to your CEX balance, you’re technically in the same ecosystem.

With self-custodial crypto cards, it’s different: they function similarly to liquidity bridges, where you lock funds (crypto) on Chain A (crypto balance) and unlock them (fiat) on Chain B (real world).

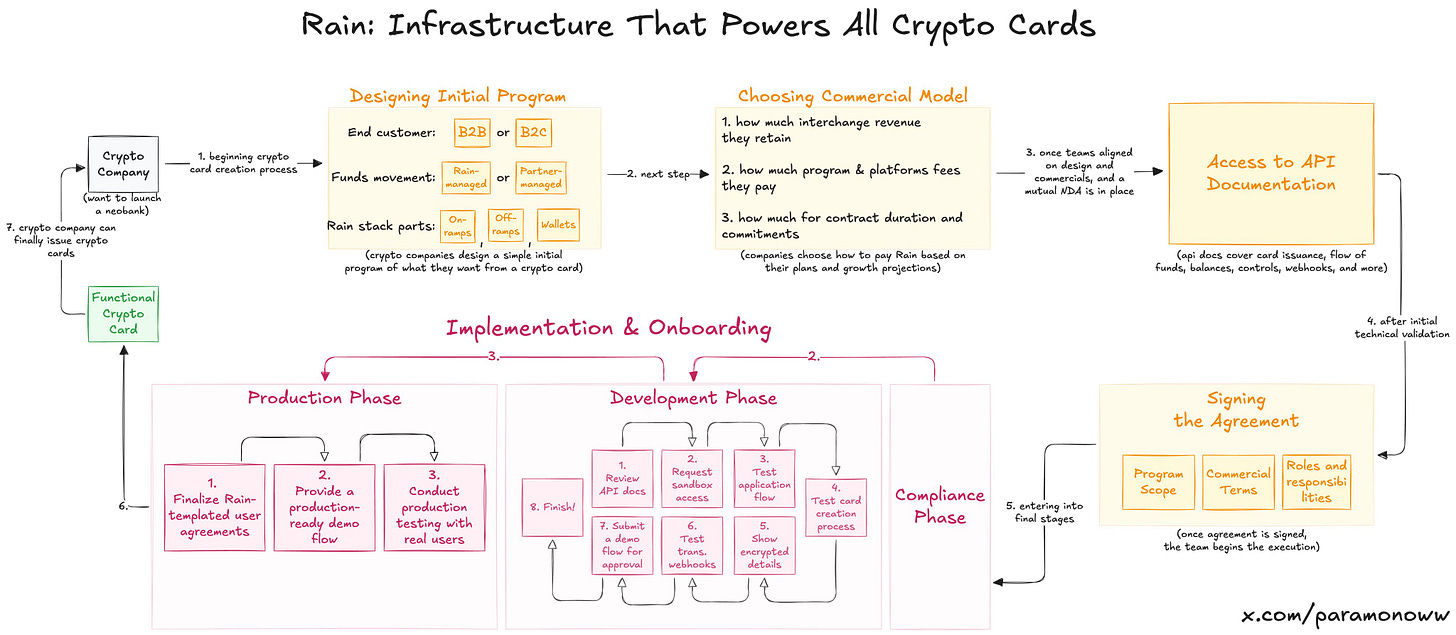

This bridge in the crypto card landscape is what shovels used to be in the California Gold Rush: the precious safe spot connecting crypto-native users and businesses who want to issue their own card.

@stablewatchHQ did a really good job highlighting this kind of bridge as essentially a Card-as-a-Service (CaaS) model. This is the most overlooked aspect by everyone talking about crypto cards. These CaaS platforms provide the infrastructure to launch their own branded card.

Rain: How crypto cards are made

Probably half of your favorite crypto cards are powered by @raincards, and you probably haven’t heard of them. This is one of the most foundational protocols in neobank systems because they carry basically every piece behind your crypto cards. What companies are left to do is just slap their logo on top of it (that’s harsh, but that’s close to how things really are).

Rain allows companies to launch their crypto cards, and honestly, Rain is infrastructure that can last even outside crypto with its execution. So yep, don’t be delusional and believe that teams need to raise tens of millions of dollars to launch their crypto card. They don’t need that — they need Rain.

The reason I’m talking about Rain so much is that people overestimate the effort needed to launch a crypto card. Maybe I will write a separate article on Rain in the future, because this is a really underrated piece of technology.

Crypto cards don’t have any privacy and anonymity

Crypto cards not having privacy or anonymity is not a problem of crypto cards, it’s a problem ignored by people pushing crypto cards forward while hiding behind so-called “crypto values”.

Privacy doesn’t exist in crypto as a widely used feature. Pseudoprivacy (pseudo-anonymity) does exist because we don’t see names, just addresses.

However, if you’re ZachXBT, Igor Igamberdiev from Wintermute, Storm from Paradigm, or any other person with strong on-chain skills, you can significantly narrow down which address belongs to whom.

Of course, the situation with crypto cards doesn’t offer any near pseudoprivacy like traditional crypto does, because you do KYC when you open a crypto card (because you don’t really open a crypto card, you open a bank account).

If you’re based in the EU, your crypto card provider still sends some of your data to the government for tax purposes or any other purposes the government would like to know.

Now, you give authorities one more opportunity to track you: linking your crypto address to the real person.

Personal data as a currency of the future

Cash is still here (the only form of anonymity, except that the seller sees you), and it will still be around for a long time. But eventually, everything will be converted into digital. Current digital systems don’t benefit the privacy of spenders in any way: you spend more, you pay more fees, and in return, they know even more about you. Good trade!

Privacy is a luxury, and it will continue to be so in the crypto card landscape. An interesting thought is that if we achieve really good privacy to an extent that companies and entities are willing to pay for it (not the Facebook way, but with our own consent), it might become one of the currencies of the future, if not the only one, in a no-job, AI-driven world.

If it’s all doomed, why are Tempo, Arc Plasma, Stable being built?

The answer is pretty simple — locking users into ecosystems.

Most of the non-custodial cards choose L2s (MetaMask on @LineaBuild) or separate L1s (Plasma Card on @Plasma). Ethereum or Bitcoin is usually impractical for such operations because of high costs and finality. There are some cards that use Solana, but I’m not here to start another war, it’s still a minority.

Of course, companies choose different blockchains not only because of their infrastructure but also because of monetary benefits.

MetaMask is using Linea rails not because Linea is the fastest or most secure, but because both Linea and MetaMask are parts of the broader ConsenSys system.

I’m using MetaMask as an example here specifically because of their usage of Linea. As most of you know, almost no one uses Linea, and it’s nowhere near the competition among different L2s like Base or Arbitrum.

But ConsenSys made a smart decision by having Linea underneath their card, because users get locked into the ecosystem. They get used to good UX not via something they use every day. Linea attracts liquidity, volume, and all other metrics in a natural way, not because of liquidity mining campaigns or begging users to bridge.

This approach is similar to what Apple did when the iPhone arrived in 2007, so people stay on iOS and get used to it to an extent that they can’t go to another ecosystem anymore. You should never underestimate the power of habit.

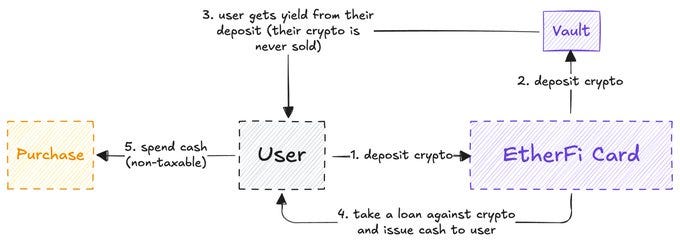

EtherFi is the only viable crypto card

After all these thoughts, I came to the conclusion that @ether_fi is probably the only viable real crypto card that aligns most with the crypto ethos (this research is not sponsored by EtherFi, but even if it were, I wouldn’t mind).

In most crypto cards, they sell the crypto that you deposit and top up your balance with cash (similar to a liquidity bridge that I described before).

It’s different in EtherFi: the system never sells your crypto; they give you cash as a loan and use your crypto to yield rewards.

EtherFi functions similarly to Aave with this model. While most DeFi users are dreaming of the ability to take a cash loan against their crypto assets seamlessly, it’s already here. You might wonder: “But isn’t it the same thing? I can top up crypto and use a crypto card as a normal debit card; this one extra step isn’t needed”.

Well, the problem is: selling your crypto is a taxable event, sometimes even more taxable than daily purchases. And with most cards, each of your operations is taxed, so you have to pay more to the government (again, using a crypto card doesn’t mean going bankless).

EtherFi kind of fixes this because you don’t really sell your crypto; you just get a loan against it.

Just because of this reason alone (on top of no FX fees in USD, cashback, and different perks), it makes EtherFi the best example of the DeFi × TradFi intersection.

While most cards try to pretend that they’re crypto while being literally a liquidity bridge, EtherFi is literally aimed at crypto users first rather than focused on bringing crypto to the masses: they bring crypto to locals and make locals spend in front of the masses until they realize how cool that is. Out of all crypto cards, EtherFi is possibly the only one that will survive over the years.

I like to think of crypto cards as a field for experimentation, but unfortunately, most of the teams you see just capitalize on the narrative without giving proper credit to the underlying systems and the people who work on these cards.

Let's see where progress and innovation will lead us. Currently, we see a lot of globalization (horizontal growth) of crypto cards, but we don't see enough vertical growth, which is needed in the early days of a technology like crypto cards designed for spending.